Dear Investor,

While the broad stock market indices remain at near-record levels, there are sectors of the market that have dropped into correction or even bear market territory over recent months.

So while income-focused investors, such as my subscribers, continue to generate high-yield income, investors focused on more aggressive stock trading are feeling the pain.

Here are the details – and a good stock to get out from under this hidden bear market…

Stock market jargon defines a correction as a decline of more than 10% from the previous high mark. Bear market territory starts with a drop of more than 20%. Throughout 2021, each time the S&P 500 pulled back by around 5%, investors “bought the dip,” and the index quickly recovered.

The SPDR S&P 500 ETF (SPY) hit its most recent record high of $473.54 on November 22. Ten days later, on December 3, the SPY price hit $448.92, a drop of 5.2%. Now, the day after the Federal Reserve report on December 15, the share price has recovered to $470.

Yet, the relative stability of the S&P 500 hides some severe declines in many stock market subsectors. The State Street SPDR group lists 30 different subsector and industry ETFs. As I write this on December 16, a dozen sector funds are in correction territory, and four are in or very near to bear market level declines.

Here are some of the fallen funds. I find the diversity of pain for investors to be surprising.

- Worst hit: SPDR S&P Biotech (XBI), down 35.6% from its 52-week high

- SPDR S&P Oil &Gas Equipment & Services (XES) down 26.1%

- SPDR S&P Internet (XWEB) down 25.6%

- SPDR S&P Pharmaceuticals (XPG) down 19.5%

- SPDR S&P Software and Services (XSW) down 13.7%

- SPDR S&P Healthcare (XHS) down 12.7%

I selected these ETFs and their returns as representative of where investors may have put their money trying to catch a hot investment. It was a surprise to me to see biotech in such a slump.

The best performing SPDR ETFs are near breakeven from their 52-week highs. As I write this, The Consumer Staples Select Sector SPDR Fund (XLP) has the best results, down just 0.10% from its 52-week high. These funds also are holding ground in relation to recent highs:

- The Utilities Select Sector SPDR Fund (XLU)

- The Healthcare Select Sector SPDR Fund (XLV)

- The Real Estate Select Sector SPDR Fund (XLRE)

The Select Sector SPDRs track broader coverage indexes than the SPDR industry ETFs, which accounts for the greater volatility in the latter group.

My point here is that picking and chasing the next hot sector can lead to significant losses in your portfolio. I constantly encourage investors to develop a long-term strategy that will work for years to generate income and grow their portfolios.

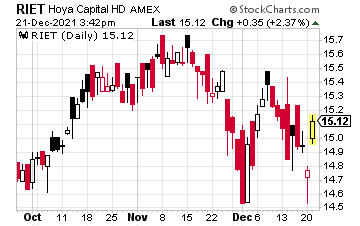

One new investment that fits the bill is the Hoya Capital High Dividend Yield ETF (RIET). This fund owns REITs, dividend growth stocks, and preferred shares to generate an attractive 6.8% yield and growing dividends.

That’s only one example of the almost three dozen dividend stocks I’ve picked out for the Dividend Hunter portfolio. Each one of them has to pass my rigorous screening and research process before I show it to my subscribers as a stable, low-risk, and high-yield way of generating income no matter what the markets do.To learn more about my favorite one of these stocks for 2022, and how to get access to the full list, click here.