Every earnings season, I check the results from hundreds of publicly traded companies. In the past, for most companies, a quick scan of the earnings results would show whether or not a company remained on its expected trajectory. The 2020 fourth-quarter earnings results will be very different. They will tell the tale of a very disruptive year and how each company struggled or thrived by the end of it.

I am old school, meaning I recommend stocks in which I want to participate in the business results. With my focus on dividends, I look for the amount of revenue that falls to free cash flow and then how much of that cash flow gets shared with common stock investors.

Each quarter I review financial results from hundreds of companies. My areas of expertise include high-yield stocks and dividend growth companies. In “normal times” for most stocks, a quick scan of results would show whether a company stayed on track for the quarter. Exceptions would stand out and require further research.

The 2020 fourth quarter results need a more in-depth review. Last year produced a wide range of results. Some companies almost shut down early in the year and then slowly resumed business operations. Some saw stock prices crash, even as business results remained steady throughout the year.

Earnings releases start this week and will be out hot and heavy for the next month. I’ll be particularly focused on stocks in the Dividend Hunter portfolio. For each company, I will look for answers to the following questions:

- How did the pandemic affect business results?

- How did results change from the first quarter through the end of the year?

- If the pandemic affected business results, what was the recovery progress through 2020?

- If net income was down compared to 2019, what is the current dividend coverage?

- If dividends were reduced in 2020, what does management say about restoring payouts to pre-pandemic rates?

- How will continued economic shutdowns across the U.S. affect business results for the first half of 2021?

I am looking to find companies poised for nice stock gains and dividend increases and want to stay away from those that look like they will continue to languish.

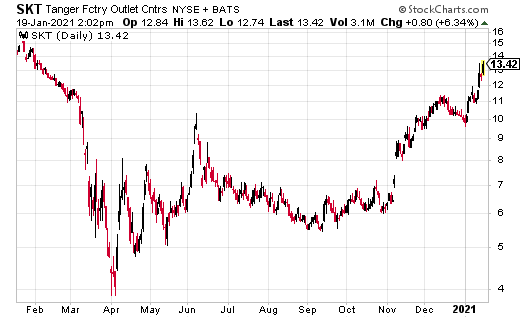

A good example occurred last week when Tanger Factory Outlet Centers (SKT) announced their first dividend after suspending payouts last May. Even though the new dividend is half the previous rate, the stock popped 10%, and the SKT share price has gained 17.3% in January.