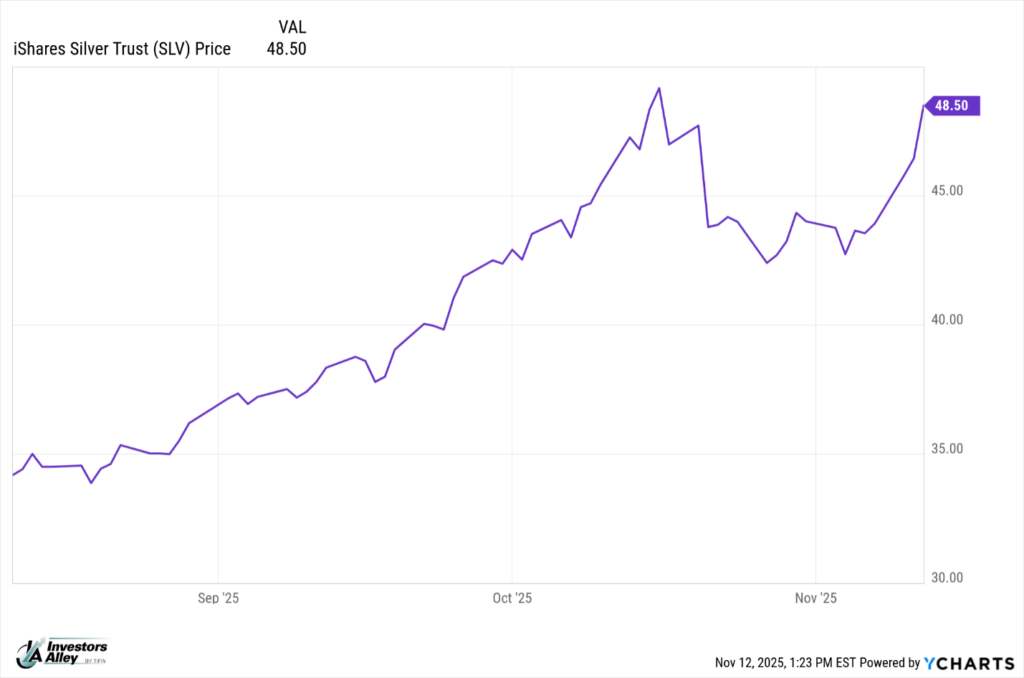

The precious metal silver has been red hot, up 71% over the last year. The iShares Silver Trust (SLV) has gained 42% in the previous three months. A 10% drop in late October was short-lived.

The downturn’s failure to be sustainable is a good indicator that silver will continue to march higher.

My investment newsletters focus on income investments, so I am always on the lookout for high-yield ETFs with interesting underlying assets.

On September 29, 2025, ETF sponsor Kurv launched the Kurv Silver Enhanced Income ETF (KSLV). According to the Kurv website, KSLV seeks to outperform the return of silver. Here is the official investment objective, from the site:

Kurv Silver Enhanced Income ETF seeks to maximize total return by actively managing a portfolio with efficient exposure to silver while, at the same time, generating potentially tax-efficient income.

KSLV pays monthly dividends, with payments typically made around the 20th of each month. The October dividend was the first and, so far, only one to be paid. The listed distribution yield is 23.48%.

Recently I sat down with the Kurv CEO, Howard Chan, to discuss his new ETF. It was a subscribers-only live event that I offer to my paid subscribers. He stated that KSLV was designed to outperform raw silver by combining long silver exposure with active option-writing to generate high levels of income. The host points out the strong backdrop for silver—massive price gains over the past year.

As he explains the mechanics of KSLV’s overlay: the fund holds silver futures while tactically writing options to harvest volatility premium. This approach, he says, allows the fund to potentially offer both strong upside participation and unusually high distribution yields, which immediately caught the attention of income-focused investors, including me.

Unlock Double Digit Yields from this New Class of ETFs

If you use this information before today's market close, you could watch your income potentially grow by hundreds or even thousands of dollars faster than you ever thought possible... plus find out how to get the name, ticker, and details on a new ETF with an 81% yield. Click here.