With five-sevenths of the Magnificent Seven stocks reporting earnings this week, perceived negative news could cause a drop in share prices. And if one starts to drop, investor sentiment could likely force a selloff of all seven.

However, these are the most successful seven public companies in the U.S., and their long-term prospects are outstanding. We call them “magnificent” for a reason.

Roundhill Investments has established the Roundhill Magnificent Seven ETF (MAGS). It owns the seven stocks with an equal weight. Here are its holdings:

While MAGS offers a great way to get equal weight exposure to the seven stocks, I prefer another fund from Roundhill.

The Roundhill Magnificent Seven Covered Call ETF (MAGY) owns shares of MAGS and sells call options against that portfolio. Covered call trading allows investors to earn cash income. In a strongly rising market, MAGS will outperform MAGY. In most other market conditions, MAGY can perform as well as or better than MAGS.

The exciting feature of MAGY is that it has a current yield of 34.73%. Dividends are paid weekly on Mondays.

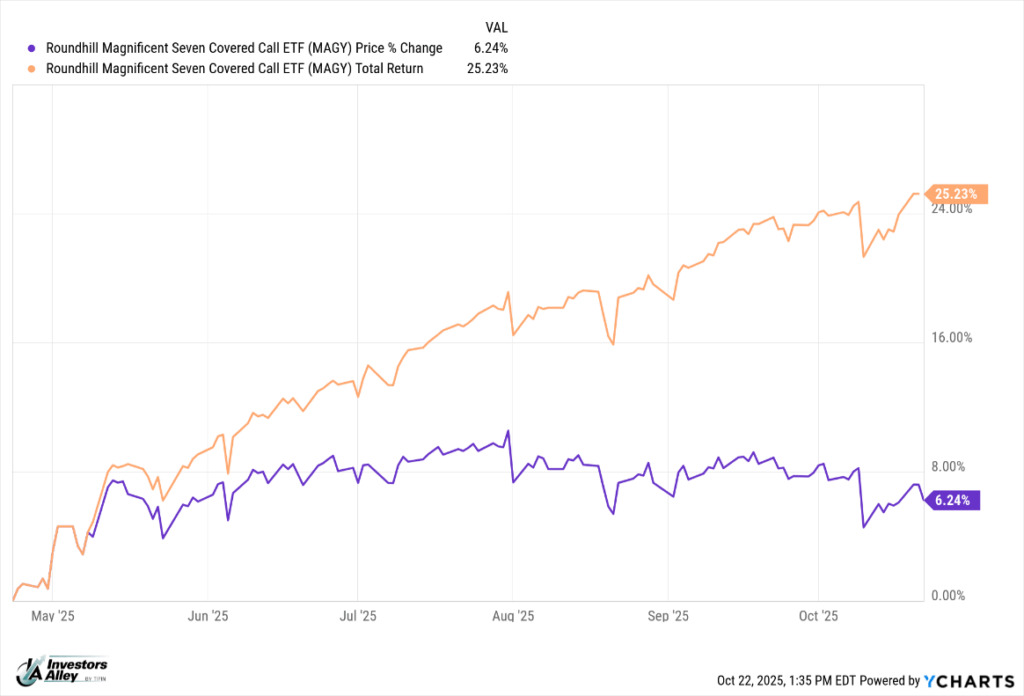

MAGY launched on April 23, 2025. Here is the chart of the share price and total return since the IPO:

MAGY is a portfolio investment that I follow regularly for my readers.

Deadline Coming Up: Lock In Up To 80% Dividend Yields

My portfolio has three Bitcoin related high-yield ETFs paying massive dividends. The deadline is coming up on Wednesday to get started. My new report shows you how to get set up and start collecting dividends from Bitcoin without ever actually having to own any Bitcoin. It’s an intriguing idea to collect dividends from Bitcoin without even owning it but I’ve been doing this for nearly a year now with dividend payments piling into my account.