Rocket Companies (RKT), the parent of mortgage lender Quicken Loans, made its initial public offering debut in early August. The company raised roughly $1.8 billion in its IPO, much less than the $3.3 billion that had been expected.

RKT had priced 100 million shares at $18, with the deal size cut from 150 million in common stock at a prior $20-$22 range. A week later, the company reported preliminary second-quarter adjusted revenue of $5.3 billion, up over 150% compared to its first quarter 2020 and 300% compared to its second quarter of 2019. Adjusted net income for the second quarter came in $2.8 billion, an increase of 335% compared to the first quarter of 2020 and 995% compared to the second of quarter 2019.

In early November, RKT reported third-quarter earnings of $0.54 cents per share, versus forecasts of $1.09. Revenue of $4.63 billion also missed expectations of $5.31 billion. Despite the disappointing miss, shares rallied 3% the following session.

Rocket Companies’ CEO, Jay Farner, stated: “In the midst of the pandemic, we were able to help an unprecedented number of Americans buy and refinance homes, providing financial relief through our tech-driven platform and award-winning service.”

The big takeaway from the last quarter was the approval of a share repurchase program that became effective November 10. According to a press release on that date: “The share repurchase program authorizes the Company to repurchase shares of the Company’s common stock in an aggregate value, not to exceed $1 billion from time to time, in the open market or through privately negotiated transactions.”

Additionally, Rocket Companies said it sees current and four-quarter closed loan volume coming in at $88-$93 billion, or an increase of 73%–83% compared to $50.8 billion last year. The net rate lock volume was forecast in the $80-$87 billion range, which would represent an increase of 82%-98%, compared to $43.9 billion last year.

There are currently 12 analysts that cover the stock: two give RKT a strong buy rating, one buy, eight holds, and one an underperform rating. The most recent coverage came from an analyst that initiated coverage of RKT with a Buy rating and $27.50 price target.

Record low mortgage rates and the pandemic-related migrations out of urban centers will continue to drive the housing market into the 2021. Reduced seasonality and the mild weather until recently will likely exacerbate the strength in the housing market as well.

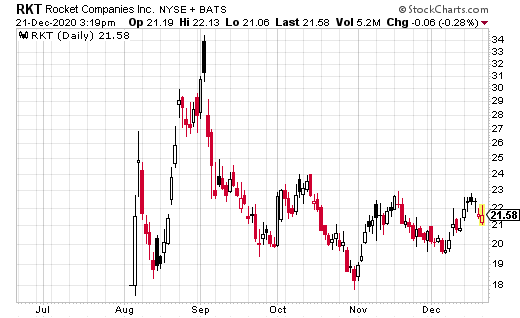

Although shares have shown strength of late, they are still down 35% from the early September peak of $34.42. The chart below shows near-term resistance in the $23–$24 area with a close above the latter and the October highs being a bullish signal for continued momentum. Support is in the $21 area and the 50-day moving average if shares retreat from current levels.

Aggressive traders looking to play a return trip to the low $30s by next summer can target the RKT June 25 call options which are currently trading for $2.80.These options would give the trade plenty of time to play out and don’t expire for six months.

If shares can trade above $31 by mid-June 2021, these options would more than double from current levels as they would be $6 in the money.