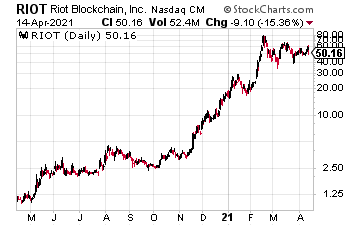

Riot Blockchain (RIOT) soared earlier this week after announcing it produced 491 Bitcoin in the first quarter of the year, a 75% increase year over year. In March alone, RIOT produced 187, an increase of 87% year over year.

“By Q4 2022, Riot expects a total hash rate capacity of 7.7 EH/s with a fleet of approximately 81,146 Antminers, 95% of which will be the latest generation S19 series model. When fully deployed, the Company’s total fleet is expected to consume approximately 257.6 MW of energy with an overall hash rate efficiency of 33 joules per terahash (J/TH). As a market leader, this continues to demonstrate Riot’s commitment to building one of the most efficient Bitcoin mining fleets in the industry,” as noted in the company’s press release.

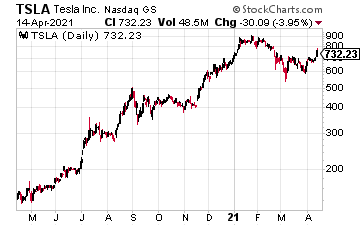

Tesla Inc. (TSLA) gained $60 after an analyst said the Street is underestimating the company’s potential. Credit Suisse analyst Dan Levy sees a beat when the company releases earnings, predicting Q1 EPS of 85 cents, as compared to estimates for73 cents. At the moment, Levy rates the stock a hold with a target price of $800.

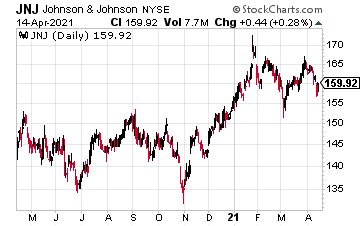

Johnson & Johnson (JNJ) pulled back on news the US FDA asked state to temporarily stop using its vaccine. All after six women in the U.S. developed a rare blood clotting disorder. However, the US FDA did add, “These adverse events appear to be extremely rare.” Johnson & Johnson has also noted there is no clear causal relationship between these events and the vaccine.

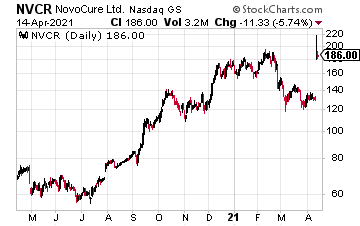

Novocure Ltd. (NVCR) rocketed higher this week after providing an update on a Phase 3 trial of its experimental lung cancer treatment. According to its press release, “Following a routine review of the study by an independent data monitoring committee (DMC), Novocure was informed that the pre-specified interim analysis for the LUNAR trial would be accelerated given the length of accrual and the number of events observed, to date. The interim analysis included data from 210 patients accrued to the LUNAR trial through February 2021.”

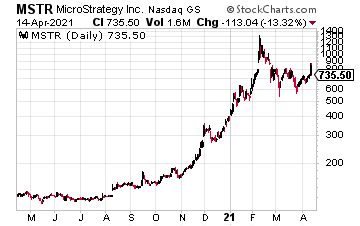

MicroStrategy Inc. (MSTR) was up more than $130 a share earlier this week on the heels of the Bitcoin boom. After buying another $15 million worth of BTC over the last week MSTR benefited significantly as BTC rallied to a new high of $63,321.

At the time of this writing, Ian Cooper did not hold a position in any of these stocks.