RSG reported strong earnings this month, easily beating the year ago quarter. The company reported net income of $246.3 million, which was above the $234.2 million reported in the prior year-over-year quarter.

RSG said earnings were $0.77 per share, which was almost 7% better than the first quarter of 2019, which came in at $0.72 per share.

Republic Services had reported issues in some areas of the country with contracting, earlier in the quarter. Some employees had to agree to reduced hours as certain localities reduced services to preserve capital.

In order to assist employees, Republic Services Group implemented a $20 million Committed to Service initiative during the quarter. The company purchased food and other supplies from local businesses, and distributed the purchases to Republic employees.

Donald W. Slager, Republic Services Group CEO, noted the company has made strategic long-term investments, which are paying off in the current environment.

Slager said, ”We’ve made several key investments, including developing standardized processes and procedures, implementing innovative technology to enhance employee safety and efficiency, consolidating our customer service operations and building world-class procurement and business continuity functions.”

The company has a reported $1.9 billion in available liquidity, as of March 31, 2020. This includes almost $300 million in cash, and an available borrowing capacity under an already established credit facility, of $1.6 billion.

Buy and Hold This Dividend Stock Forever: Payout Coming Up [ad]

For the quarter, Republic’s EBITDA margins were 28.3%, matching the year-over-year quarter. The company said a number of offsetting factors went into the number. Lower recycled commodity costs, and an additional workday in the quarter, were negative impacts. But, these were offset by lower fuel prices and a tax credit.

Jon Vander Ark, Republic Services Group president, said that in addition to the Committed to Service initiative, the company also took on additional costs in the quarter related to employee safety. Vander Ark noted, “We have taken several steps to keep our employees safe, including providing masks, implementing enhanced cleaning procedures and expanding employee benefits.”

As many companies are doing, Republic Services Group withdrew full-year 2020 guidance, citing COVID-19 as a complicating factor in projecting earnings. The company said it had “limited visibility into the timing and sequencing” of increased economic activity in the U.S., and that activity would likely be uneven.

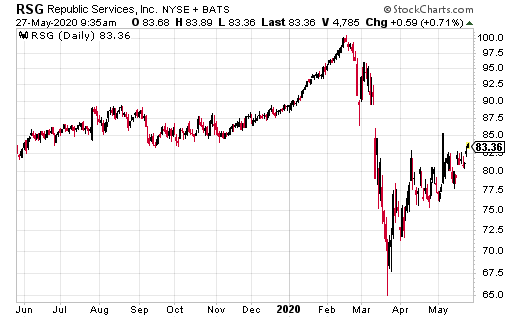

The stock initially gapped higher on the earnings news, but has since pulled back, and is now climbing higher to fill the initial gap. The company’s current PE ratio is 24.4.

Steven Adams’s personal position in Republic Services Group: none.