ON Semiconductor (ON) shares have been on a roll this month after announcing a blowout quarter that exceeded Wall Street’s forecasts. The company is a leading supplier of power and analog semiconductors, as well as imaging sensors—a white-hot market of late.

One of the biggest developments to ON’s solid quarter was the company’s concentrated effort in shifting its focus from the consumer and computing markets to the automotive, industrial, and communications markets.

Despite the supply chain issues that have plagued much of corporate America, ON Semiconductor has done well in navigating these issues since acquiring GT Advanced Technologies in August, a producer of silicon carbide (SiC). The $415 million cash deal gave ON Semiconductor an experienced partner in crystalline growth, including SiC, and a key material used in electric vehicles and green energy infrastructure.

The acquisition is already paying dividends, as evident in ON’s most recent quarter: on November 1, the company reported a third-quarter profit of $0.87 per share on revenue of $1.74 billion. Wall Street had been expecting $0.74 and $1.71 billion, respectively. For the current quarter, ON Semiconductor said it expects profits between $0.89–$1.01, versus forecasts of $0.75, with revenue of $1.74–$1.84 billion, above estimates of $1.72 billion.

To add even more sizzle to this rosy outlook, gross margins are expected to come in between 42%–44%. More importantly, the company’s CEO, Hassane El-Khoury, is delivering on his longer-term strategy to improve the company’s structural margins and leverage growth opportunities.

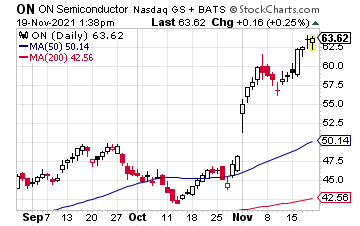

Following the news, a dozen analysts raised their price targets on the stock to the low to mid-$60s, with the high checking in at $75. Given this month’s momentum, shares are easily on track to meet these expectations. The chart below shows a double-top breakout above $50 and key resistance from September, with shares at an all-time high. Current support is at $60 with a close back below this leveling signaling a possible near-term top. RSI (relative strength index) is signaling shares are in overbought territory with a reading near 80.

Subscribers to my newsletter, 30-Day Double Up, benefitted from this parabolic move as we were positioned in the ON Semiconductor November 50 call options for $1.00. We took half- and quarter-profits following the earnings news over the next four sessions, with an average overall exit price of $6.625, for a gain of 563% – here’s how.

While it was prudent to take these massive gains off the table, options peaked at $13.45 a day before expiration. Of course, we could have seen an even bigger profit potential of more than 1,200%, had we held the position into expiration. However, it’s hard to complain after hitting a five-bagger in less than a week.

I will continue to monitor ON Semiconductor for a possible reentry point, as it remains a solid long-term investment. My guess is that shares could trade to $100 at some point in 2022 if the company keeps firing on all cylinders.