Shares of Nike Inc. (NKE) exploded more than 12%, or $14.30 earlier this week. All after crushing earnings expectations. EPS of 95 cents easily beat expectations for 47 cents. Revenue of $10.59 billion was also far better than estimates for $9.15 billion.

According to CNBC, “The company has used the coronavirus pandemic as an opportunity to accelerate its digital business, and its women’s apparel division grew nearly 200%. As parents stocked up on back-to-school items, and its business picked back up in key markets like China, Nike said its Jordan brand is looking “stronger than ever.”

“The company also offered a fresh outlook for fiscal 2021, expecting sales to be up high single digits to low double digits from a year earlier. The outlook comes at a time when many of its rivals are avoiding financial guidance.”

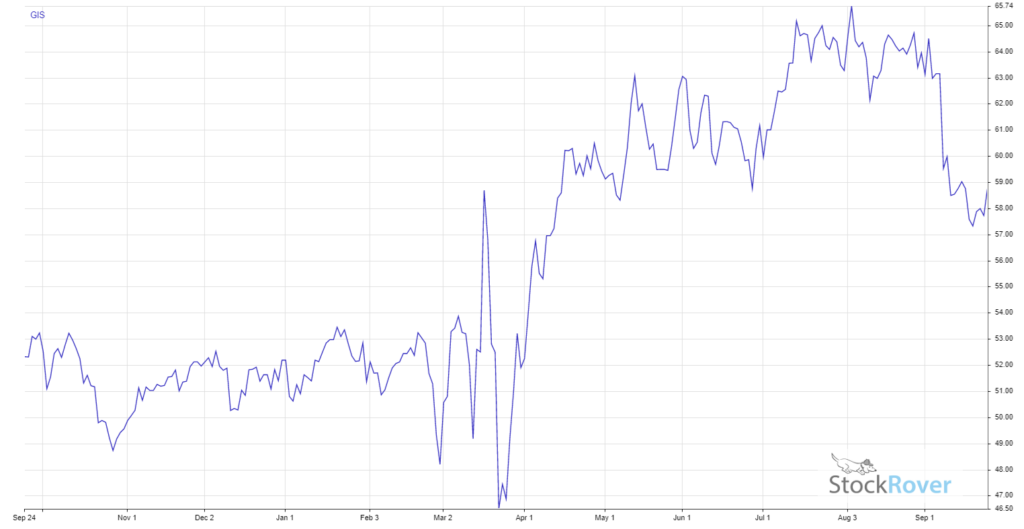

General Mills Inc. (GIS) pushed higher on a Q1 earnings beat, and news of a raised dividend.

Net income came in a $638.9 million, or $1.03 per share, up from $520.6 million, or 85 cents per share, year over year. Adjusted EPS of 27 cents beat the estimates for 87 cents. Sales of $4.36 billion were up from $4 billion year over year and also beat estimates. General Mills also declared a quarterly dividend of 51 cents on Nov. 2 to shareholders of record as of Oct. 9.

Shares of Tesla Inc. (TSLA) are dropping on news new innovations won’t be here as quickly as expected. All after Elon Musk dampened the mood, as he cautioned about hurdles to mass production. “Important note about Tesla Battery Day unveil tomorrow. This affects long-term production, especially Semi, Cybertruck & Roadster, but what we announce will not reach serious high-volume production until 2022,” he tweeted.

On recent weakness, Oppenheimer analyst Colin Rusch says he would be “buyers on any near-term weakness.” The analyst also reiterated an outperform rating on the stock with kept a price target of $451 a share.

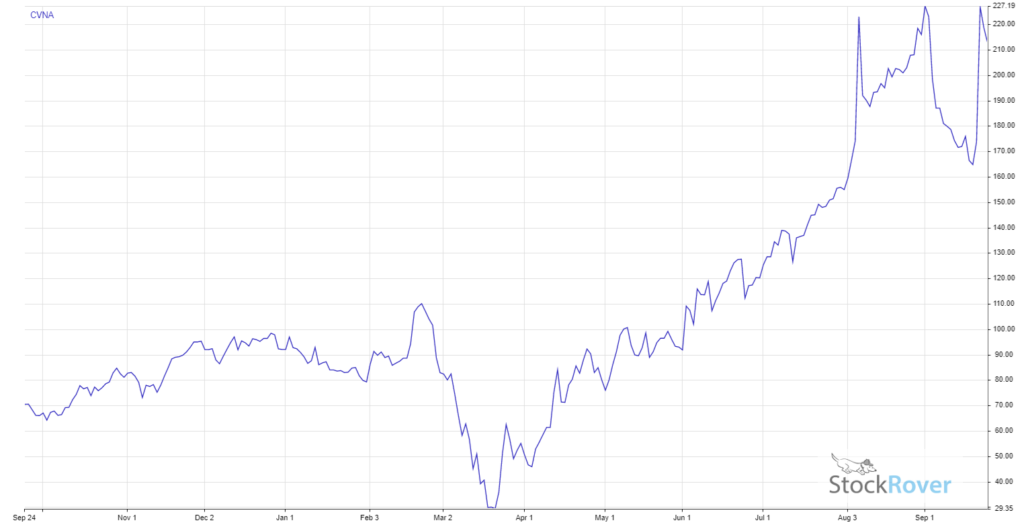

Shares of Carvana Co. (CVNA) exploded 30%, or $53 a share on projections the company will record revenue and profit margins. “Covid-19 is prompting consumers to seek out used cars, and CVNA is a key beneficiary of this trend,” said Alexander Potter, an analyst at Piper Sandler, in a research note, as quoted by Bloomberg. In addition, according to Barron’s, Goldman Sachs’ Daniel Powell says he sees, “a long runway for growth in this category,” and that valuations for Carvana had overcorrected.

Shares of Peloton Interactive Inc. (PTON) pulled back on news Amazon.com is entering its space. In fact, Amazon and Echelon just teamed to offer a $499 Prime Bike. However, “This bike is not an Amazon product or related to Amazon Prime,” an Amazon spokesperson said, as quoted by Barron’s. “Echelon does not have a formal partnership with Amazon. We are working with Echelon to clarify this in its communications, stop the sale of the product, and change the product branding.”

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.