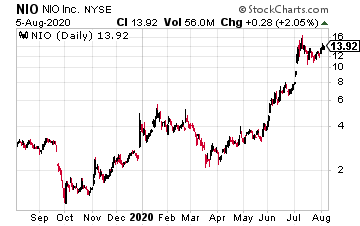

Shares of electric carmaker Nio Inc. (NIO) exploded above $14 a share on July 2020 sales news. For July 2020, the company delivered 3,553 vehicles – up 322% year over year. NIO has now delivered 17,702 vehicles for the year – up 111% year over year.

“In July, we are pleased to have achieved the second-highest monthly delivery results despite the impact on productions due to a 5-day suspension of manufacturing to prepare for EC6 productions and other flood-related supply chain challenges,” said William Bin Li, founder, chairman, and chief executive officer of NIO.

“More proudly, we have achieved a record-high monthly order growth, attributed to a stronger demand of the ES8 and ES6, together with the increasing EC6 orders, thanks to the continuous support of our users. We believe we will be able to increase our production capacity significantly to support higher deliveries in the third quarter of 2020,” he added.

For June 2020, NIO sold 3,740 EVs for the month, up 179% year over year.

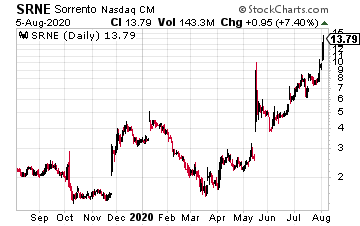

Sorrento Therapeutics (SRNE) popped more than $3 a share on Tuesday after HC Wainwright reiterated a buy rating on the stock with a price target of $30 over the next 12 months.

According to Tip Ranks, “Last week, Sorrento announced it had inked a licensing deal with Columbia University for an innovative new COVID-19 test. The university has given Sorrento the rights to a fast, one-step diagnostic test that samples saliva and can detect the SARS-CoV-2 virus in 30 minutes.”

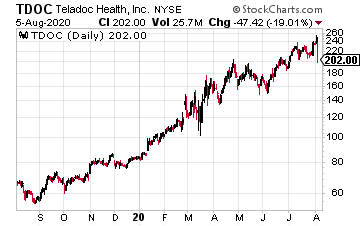

Teladoc Health (TDOC) jumped more than $12.25 on Tuesday to $249 after President Trump signed an executive order to expand telehealth services. “We’ve been providing telehealth services at a rate and a speed during the pandemic … and the president wants to make that benefit permanent for Medicare recipients, and that’s going to be a tremendous boon for people living in rural areas but also for the entire country,” said Centers for Medicare and Medicaid Services administrator Seema Verma, as quoted by Fox News.

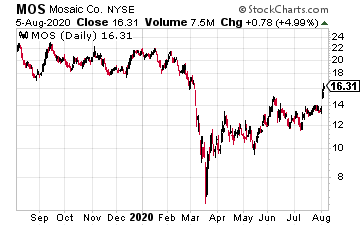

Shares of The Mosaic Company (MOS) were up 13.5%, or $1.85 on Tuesday after posting Q2 2020 earnings. The company reported second-quarter net income of $47.4 million, or 12 cents a share, as compared to a loss of $233.1 million, or 60 cents a share, year over year. Adjusted earnings were 11 cents a share. Revenue fell to $2.04 billion from $2.18 billion in the year-ago quarter, as reported by MarketWatch.

“As Covid-19 continued to impact the global economy, agriculture and food security continue to be global priorities resulting in limited impact to agricultural inputs, including fertilizer and its supply chains,” Mosaic added.

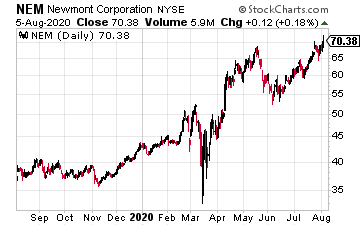

Newmont Mining (NEM) jumped more than $2 a share to $70.25, as gold prices topped $2,000 on Tuesday. Gold prices could move even higher thanks to fallout from the coronavirus, economic fears, tensions with China, central banks pumping liquidity into markets, and fear ahead of U.S. elections. Worse, the International Monetary Fund estimates the global economy could shrink by up to 5% this year, prompting central banks to pump billions into the financial markets. From here, we could see $3,000 gold, noted by Bank of America.

As of this writing, Ian Cooper does not have a position in shares of INSG.