Precious metals, gold and silver, have posted great returns this year. The uptrend appears likely to continue. My newsletter services focus on dividend-paying investments, so I am always interested when a new ETF that generates income from a non-dividend-paying underlying asset hits the market.

On September 29, Kurv Investment Management launched the Kurv Silver Enhanced Income ETF (KSLV). According to the fund’s webpage and launch press release, KSLV aims to provide investors with enhanced income while outperforming the price return of physical silver. From the press release:

“The price of silver historically followed the price of gold, which has reached an all-time high as investors look to diversify risk and inflation hedges in portfolios,” said Howard Chan, founder and chief executive officer of Kurv Investment Management. “KSLV is designed to capture the price appreciation potential while generating tax-efficient income on a non-cashflow asset.”

“Along with Kurv’s gold strategy, KSLV extends Kurv’s mission to offer sophisticated investment products to the masses,” said Chan. “Our precious metals suite further enhances investors’ goal to diversify their portfolio without sacrificing income generation capabilities.”

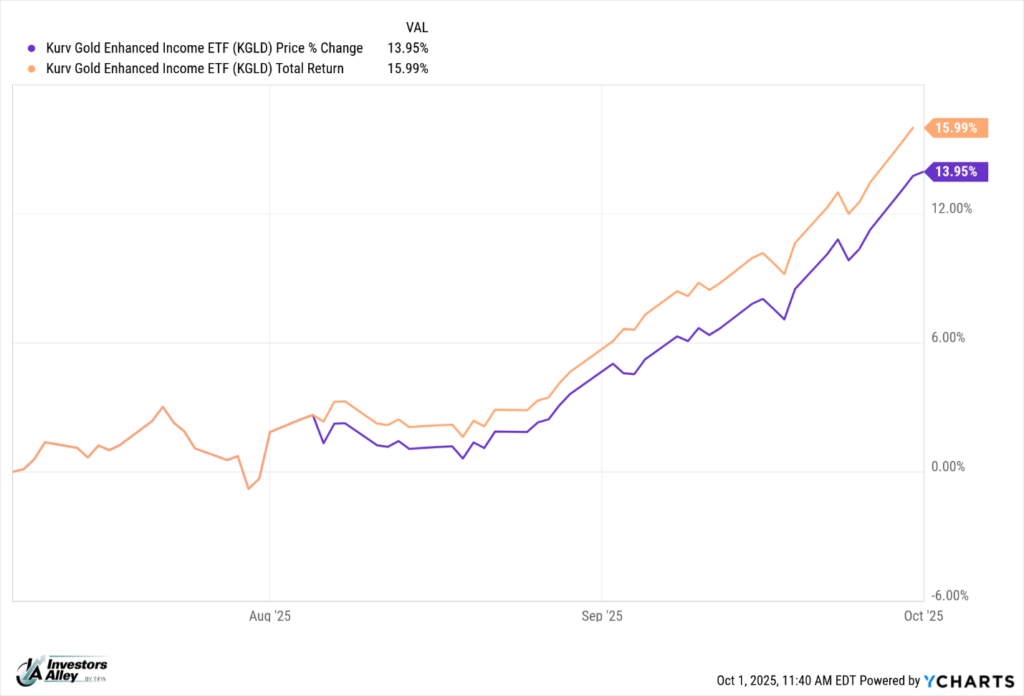

KSLV is a brand-new ETF, so we have no track record to review. However, the company had previously launched the Kurv Gold Enhanced Income ETF (KGLD) on July 8., which gives us about two and a half months of track record to examine.

Editor’s Note: Tim hosted a webinar with Howard Chan from Kurv recently to discuss several of the firm’s ETFs. The webinar was for Tim’s Dividend Hunter subscribers and a replay has been posted online. Click here to find out how to become a subscriber and get immediate access to the replay.

KGLD pays monthly dividends (as will SLV), with a current yield of 11.51%. Since its launch, KGLD has posted a total return of 15.99%. That’s in just two and a half months. The SPDR Gold Shares ETF (GLD) returned 16.8%.

Gold and silver are hot. KGLD and KSLV allow you to match the precious metals returns if they keep going up, and earn an excellent yield if the gains stagnate.al returns to investors. We currently have 14 outstanding ETFs in our recommended portfolio.

Potentially Collect Up To $5,917 Monthly From America's $500B Factory Boom

Apple investing $500B, Microsoft $40B, Nvidia billions in American factories. Manufacturing renaissance creating historic wealth. But regular stocks pay almost nothing in dividends. New ETFs could change everything: Nvidia from 0.03% to potentially up to $591 monthly on $5,000. Tesla from $0 to potentially up to $452 monthly. Apple from 1% to potentially up to $279 monthly. Simple as buying a stock. Income can start within 30 days. Get The Strategy Now.