All after the company said its potential COVID-19 vaccine produced a “robust” immune response in all 45 patients in an early stage human trial. “These Phase 1 data demonstrate that vaccination with mRNA-1273 elicits a robust immune response across all dose levels and clearly support the choice of 100 µg in a prime and boost regimen as the optimal dose for the Phase 3 study,” Moderna’s chief medical officer, Tal Zaks said, as quoted by CNBC.

“We look forward to beginning our Phase 3 study of mRNA-1273 this month to demonstrate our vaccine’s ability to significantly reduce the risk of COVID-19 disease.” If the company sees further success, the stock could run well above $100 a share, near-term.

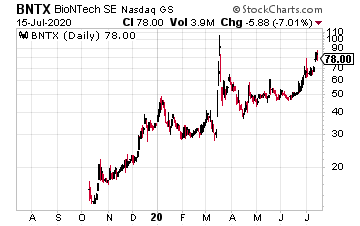

Shares of BioNTech (BNTX) rocketed from a low of $65 to $83.88 this week on news the US FDA just granted “fast track” status to it and Pfizer for a COVID-19 vaccine. According to BioNTech, two of the company’s four investigational candidates from its BNT162 mRNA-based program being developed to help protect against the virus were “fast tracked.”

Pfizer and BioNTech expect to start the next phase of the vaccine trial later this month with 30,000 subjects. If successful, the two expect to have 100 million doses of the vaccine by the close of 2020, and more than 1.2 billion by the end of 2021.

Buy and Hold These 3 Dividend Stocks Forever If You Want to Stay Retired [ad]

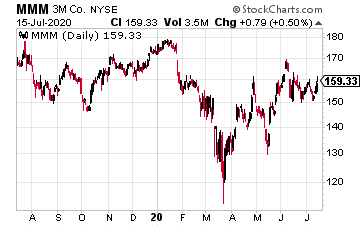

Shares of 3M Co. (MMM) is recovering on stronger demand for face masks, and on news it and MIT are working on a rapid COVID-19 diagnostic test. The device already received Phase 1 approval from the National Institutes of Health’s Rapid Acceleration of Diagnostics Tech program, which comes with $500,000 in funding to accelerate development, says CNBC.

“We’re really looking forward to understanding whether we can create a low-cost, high-accuracy device to be able to detect the antigen,” said 3M. “Our focus right now really is understanding and demonstrating that we have a device that has the accuracy that we’re looking for.”

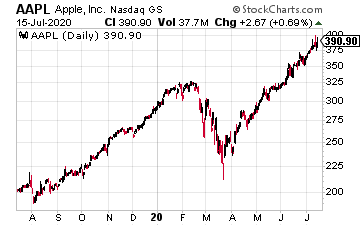

Apple (AAPL) shares neared an all-time high after analysts predicted the company could become the world’s first $2 trillion company by 2021. Part of the reason for that is the upcoming launch of its 5G iPhones this year, which could help Apple take advantage of “continued demand snapback in China,” according to Wedbush Securities, as quoted by the New York Post. In addition, Digitimes just said Apple is increasing its third quarter MacBook orders by 20% on the heels of the coronavirus.

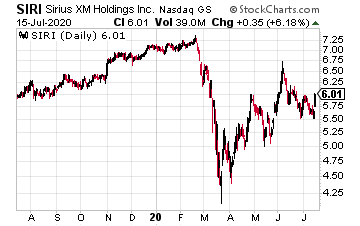

Sirius XM Holdings Inc. (SIRI) is gaining momentum on news it’s buying EW Scripps Co.’s podcast business, Stitcher for nearly $325 million, as it pushes into the podcast market. “Under terms of the deal, SiriusXM will pay $265 million in cash to Scripps, followed by $60 million in additional contingent payments based on Stitcher achieving certain financial metrics in 2020 and 2021,” says Reuters.

Ian Cooper’s Personal Position in FATE: None