While 2021 has been a very unusual year for the stock market, the most notable thing to happen is the rise of meme stocks. Meme stocks are the ones that get talked about on social media platforms like Twitter and Reddit. The first one to achieve widespread public attention was GameStop (GME).

Generally speaking, meme stocks tend to be very volatile, with most of the volume coming from retail traders. It’s amazing how much a whole lot of small trades can move a stock in a day. While this works for smaller companies, institutional volume in mega-caps keeps them from being pushed around in this manner.

The story usually starts in a forum like Reddit’s r/WallStreetBets. A person or several people will make a case for why they like a particular stock. If enough people buy into the thesis and it’s a susceptible stock (high short interest, relatively low institutional volume), then it can take off.

The action in meme stocks can go on for days or weeks. Shares of GME went from $15 to over $400 in less than a month; it is still over $200 several months later. Typically, though, meme stocks cycle from month to month (or sometimes week to week).

One of the most significant differences between the meme stock phenomenon and the internet bubble of the late ’90s is access to options. Much of the meme stock action can happen in the options market. Robinhood and low/no commission platforms have made this possible, which was not the case back in the early dotcom days.

The problem with trading options in meme stocks is how expensive the contracts can be. Extreme volatility jacks up the prices of the options, even for the very short-term expirations. (This situation makes the options attractive to sell, but it can be extremely risky to do so.)

However, there are ways to make a more affordable directional trade using options on a meme stock. One such method is by using a vertical spread. For instance, buying a call spread is a less expensive way to bet on a stock going higher. A call spread involves buying a call and selling a higher strike call in the same expiration period to help lower the trade cost (at the expense of capping your gains at the short strike).

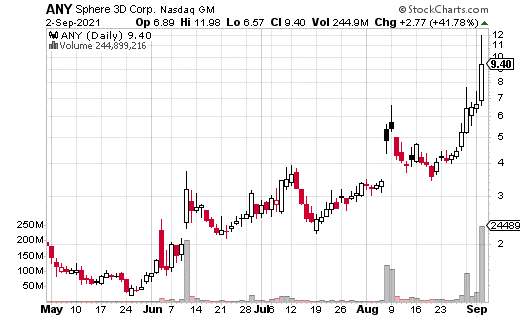

There was a perfect example of this last week in Sphere 3D (ANY). ANY was last week’s meme stock, in part due to its investment in a new SPAC. At one point last week, the stock price jumped more than 110%.

With the stock trading at around $9, a trader purchased a block of 500 October 15 10-15 call spreads for approximately $1.00. That means the 10 calls were purchased, and the 15 calls were simultaneously sold. The most that can be lost on this trade is the $1 spent on the spread if the stock price is below $10 at expiration.

The breakeven point for the trade is $11. Max gain can be reached if the stock is at $15 or above at expiration. In that case, the profit for the trade would be $4, which is a 400% return.

While buying the 10 calls by themselves would provide unlimited upside potential, they also cost $2.20 at the trade time. The call spread does cap the gain at $15, but the trade costs less than half the premium paid.