Lithium prices are gaining traction on the supply-demand story with stocks like LAC the prime beneficiaries.

According to Barron’s, “The global lithium industry produces less than 600,000 metric tons a year today. Demand is expected to hit 1.5 million tons by 2025. Even with new lithium mining projects, increased supplies of the commodity don’t seem likely to be an issue, as long as people keep buying EVs.”

It’s a big part of why lithium companies are seeing investor demand. Albemarle Corporation, for example was recently upgraded by Loop Capital analyst Christopher Kapsch to a buy from a hold with a price target of $187 from $160, according to Barron’s. “Reflecting several bigger picture developments….we have become incrementally more positive on the lithium space, and [Albemarle] more specifically,” he noted.

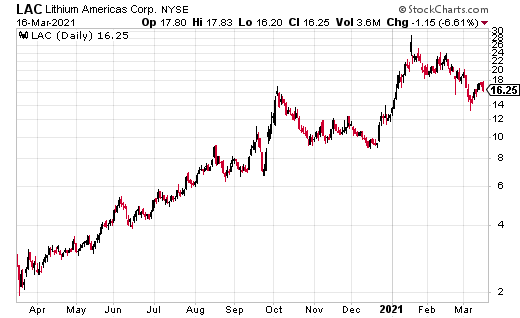

Or, look at Lithium Americas (LAC).

After finding support around $14, the stock is just beginning to pivot higher. From here, the stock could test $20, near-term. Helping, analysts at Cowen just initiated coverage of the stock with a market perform rating and a $17 price target. According to TheFly.com, “The analyst believes the market is pricing in perfect execution and start-up timing on assets that carry either timing risk or process risk for two of its largest new lithium projects.”

Lithium Americas (LAC) Recently Reported Earnings

Net loss for the year ended December 31, 2020, was $36.2 million compared to net income of $51.7 million for the year ended December 31, 2019. Net income in 2019 was a result of the gain on dilution of interest in Caucharí-Olaroz, as noted in a company press release.

In addition, construction activities at Caucharí-Olaroz continue to advance with enhanced health and safety protocols in place. With regards to its Thacker Pass property, on January 15, 2021, the US Bureau of Land Management issued the Record of Decision following completion of the National Environmental Policy Act process.

Also, the Company continues to evaluate partnership and financing opportunities for Thacker Pass, including the possibility of a joint venture partner. It also contemplates that the feasibility study will include an initial production capacity greater than 20,000 tonnes per annum of lithium carbonate equivalent previously considered.

At the time of this writing, Ian Cooper did not hold a position in Lithium Americas (LAC).