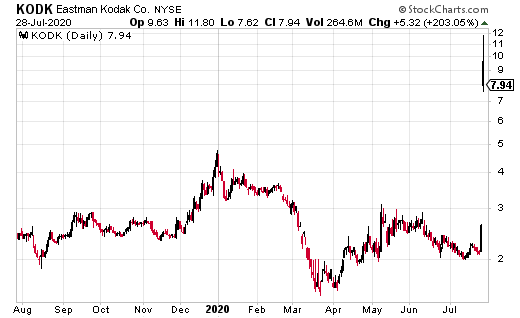

Eastman Kodak (KODK) surprised weary longtime investors this week with a deal from the government that sent the shares of the iconic film processor skyward.

The company reported it had received a loan from the U.S. International Development Finance Corporation (IDF) of $765 million to finance the production of generic drug ingredients. The loan was provided under the auspices of the Defense Production Act.

According to Adam Boehler, CEO of IDF, President Trump signed an executive order two months ago allowing IDF to invest in the United States, in specific critical need areas that address the current COVID-19 pandemic.

His organization looked at the pharmaceutical supply chain, and found that almost 90% of the generic drugs taken in the U.S. today come from foreign suppliers, with the “dominant manufacturer of ingredients” being China.

Prior to the announcement of the cash infusion, which must be paid back over a 25 year period, Kodak had already announced the founding of a new division, Kodak Pharmaceuticals. The idea was to transfer the knowledge held in the company around chemical production to the pharmaceutical industry.

Buy and Hold This Dividend Stock Forever, Even Pass it Down to Your Kids [ad]

Boehler said that “by the time we’re done, they [Kodak] will make 25% of the country’s ingredients for generic drugs.” He said the goal is to remove U.S. dependence on foreign sources of key generic pharmaceuticals.

Boehler said the load will create 360 jobs in Rochester, New York, almost immediately, working in the manufacturing process, and another 1,200 jobs to reconfigure and build out the Eastman Kodak facilities.

Boehler said the loan is partially based on advanced orders already in place for the chemicals that make the generic drugs at issue.

In its most recent quarter, Eastman Kodak had reported revenue of $267 million, an 8% decrease year-over-year for the quarter. The company reported it had issued $100 million in 5.00% convertible secured notes during the quarter, and had also completed a payment of $395 million of first lien term loans.

The company also reported an ending cash balance of $233 million at close of business in 2019. Essentially flat from ending cash levels in 2018.

The company had previously announced targeted furloughs and salary reductions in response to the COVID-19 epidemic. And, Eastman Kodak had also announced that it was producing isopropyl alcohol for hand sanitizers as well as face shields.

Steven Adams’s personal position in Eastman Kodak: none.