Shares of VIZIO Holdings (VZIO) are trading near its March initial public offering (IPO) of $21, down from a late April peak of $28.80. The company priced just over 12 million shares at $21-$23 in its debut after the deal size was reduced from 15 million shares.

In VZIO’s first day of trading, shares opened at $19.50, traded to a high of $23, before settling at $20.75. For investors looking to take advantage of the shift of TV viewing and ad dollars from linear to streaming, shares could be at an attractive entry level.

Vizio’s Smart TV allows viewers to search, discover, and access a broad array of content. The company is also the developer of an operating system for TVs called SmartCast in addition to manufacturing televisions and components. The platform gives content providers more ways to distribute their content and advertisers more options to target and dynamically show ads. For investors, VZIO provides a way to get exposure to the connected TV ad market, a business sector projected to grow from $9 billion in 2020 to roughly $28 billion in 2025.

In early May, VZIO reported a profit of $0.02 per share on revenue of $505 million. Analysts were expecting a loss of $0.10 per share on sales of $484 million.

Aside from the earnings beat, Vizio reported average revenue per user was up 75% year-over-year to $14.52, as SmartCast hours grew 70% to 3.6 billion. For the current quarter, Wall Street is expecting a loss of $0.04 per share on revenue of $380 million.

Seven analysts currently follow the stock, with four “buy” ratings and three “overweight” ratings. Price targets range from $28–$33 per share, with the high end representing roughly a 50% return from current levels.

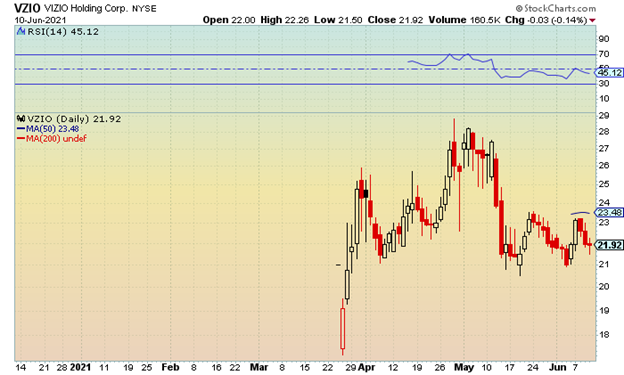

The charts below show key support at $21–$20.50, with a close below the latter signaling a pullback to the high teens. Key resistance is at $23–$23 with the 50-day moving average at $23.48.

Near-term options are available to trade on VZIO, with the longest available going into November; however, calls and puts are traded in $2.50 and $5 increments instead of $1 increments. This simply means you can buy call options at the $22.50 and $25 strikes, and put options at the $20 and $17.50 strikes.

If you go above the $25 strike price in the call options, the increments increase to $5, meaning you will have to buy a $30 or $35 strike price. For this reason, the bid/ask spreads are wider, and overall volume and open interest is extremely low.

This type of option action can be typical for recent IPOs but should improve over time. For investors looking at using options to play VZIO, perhaps selling them remains a more attractive way to get long the stock.