This past week may have been pivotal for green energy investors. Major breakthroughs in the courts and boardrooms hit three different major oil companies. Fossil fuel companies are under significant pressure to reduce their reliance on oil and gas in favor of green alternatives.

Most investors think about solar and wind when it comes to green energy investing. It tends to come as a surprise that uranium—that is, nuclear energy—is also green. The thing is, nuclear power essentially produces zero emissions. In the era of serious concerns over climate change, zero-emissions are a huge deal.

Nuclear energy is also the most efficient type of energy on the planet. A small amount of raw material can result in massive amounts of electricity generation. That raw material is uranium—at least to start with. After it’s treated and enriched and eventually may become plutonium.

Investors traditionally haven’t considered nuclear power to be green because of high-profile meltdowns and the negative publicity of nuclear waste. However, new nuclear reactors are orders of magnitude safer than the ones that had issues in the past. What’s more, nuclear waste takes up very little space, and methods for its safe storage and disposal are well known.

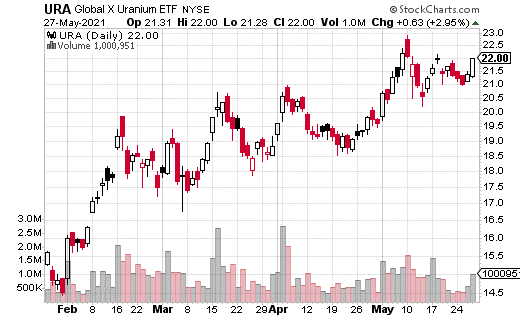

All that said, it’s no surprise that uranium companies have done quite well lately. Global X Uranium ETF (URA), a fund that owns several companies involved in the uranium industry, is up nearly 40% year-to-date.

The question is: is it too late to climb aboard the uranium train? At least one big fund or investor is still plenty bullish on uranium, at least through mid-October.

The strategist purchased a large call spread on URA that doesn’t expire until October 15. A call spread involves buying a call closer to the money while selling a further-away call at the same time. This strategy is used to reduce the upfront cost of the trade.

In this case, with URA trading for $21.91, the October 25 calls were bought while the 30 calls were sold at the same time. The total price of the call spread was $0.62, and it traded 8,000 times. That means the total cost of the trade was just about $500,000 (which is the most that can be lost on the trade).

On the other hand, the position can reach max gain if URA closes above $30 by its October expiration—roughly five months away. At max gain, the trade will pay off with $4.38 in profits, a whopping 706% gains. The breakeven point for the position at expiration is $25.62, approximately 16% higher than where we are at the time of this writing.

Call spreads are very useful for longer-term options trades like this one in URA. While the stock does need to climb another 16% to hit breakeven, $0.62 isn’t a lot of money to spend with so much time until expiration. Given how well uranium stocks have performed lately, if the trade works out, this seems like a reasonable price to pay for a substantial payout.