iQIYI (IQ) jumped higher Tuesday on news Tencent Holdings Ltd (TCEHY) has hopes of becoming a major shareholder in the company. IQ is known as the Netflix (NFLX) of China, with a streaming service that reaches over 118 million subscribers.

iQIYI has not yet reached profitability, and reported a loss of $406 million in its latest earnings report last month. That came to a loss of $0.56 per share. Losses increased 60% on a year-over-year basis.

Founder and CEO, Dr. Yu Gong, said, “Total revenues increased 9% year-over-year while user time spent and number of subscribers both achieved robust growth, with subscribers reaching 119 million, an increase of 23% year-over-year and a net addition of 12 million from the previous quarter.”

This was a decrease from the red hot 43% revenue growth the company recorded year-over-year.

Baidu (BIDU) currently owns over 90% of the voting shares of Iqiyi, so any deal reached would involve negotiations between all three parties, Tencent, iQIYI, and Baidu.

Free: Beginner’s Options Guide [ad]

While Baidu is currently listed on Nasdaq, there have been rumblings that the company is considering a move to a local Chinese exchange due to tensions with the U.S. government over Chinese stock listings.

Tencent Video is currently a competitor of iQIYI, with both companies streaming movies, reality TV shows, and dramas. Tencent currently owns the rights to stream “Game of Thrones”, the HBO hit fantasy series.

A combination, or agreement, between the two companies would allow them to share marketing costs, and increase their bargaining power when purchasing content to show on their platforms. Tencent also has over 110 million subscribers to its video service, resulting in a combined viewership of over 225 million paid subscribers.

A possible deal aims to take advantage of the weakness in traditional movie theater revenue, as film fans have been forced to stay home due to the current COVID-19 pandemic. Stay at home services have been huge beneficiaries of the new normal, with both business and leisure activity having a substantial uptick in time spent on those activities at home.

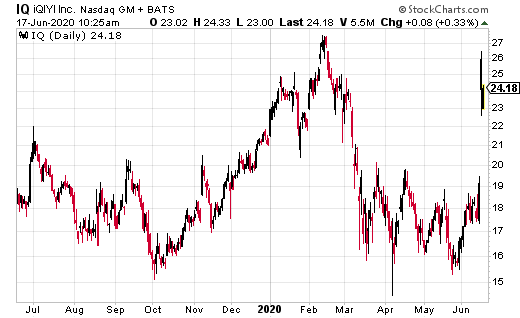

iQIYI stock, which had fallen from a high just over $27, to trade below $15 at the market lows, and most recently around $18, jumped back to just over $26 on the news.

Steven Adams’s personal position in iQIYI: none.