What the heck is going on?

In the fourth quarter, I was housebound due to medical issues. When cleared to travel in late December I bought tickets to spend Christmas with the grandchildren. I was shocked, airfares doubled over last year. Might it be because I was a last-minute flyer? When I booked our return flight, I learned that was not the case.

I took my wife Jo out for dinner at our favorite restaurant chain. The bill was 50% higher than late August. Went to our favorite steak house chain and discovered the same thing. Prices skyrocketed that much over three months?

Time for a wake-up call! Our investment portfolio did well last year. Was I kidding myself – did our investment performance even keep up with inflation or lose ground?

The most important issue

During the Carter years the Fed was concerned about fighting inflation; you could buy double-digit CDs. Today the Fed talks big, does little, while inflation soars.

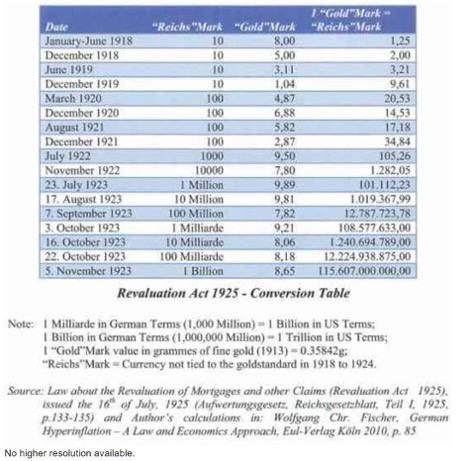

Research Online published a disturbing paper, “Hyperinflation in the Weimar Republic”. They provide the following Wikipedia graph; it’s scary!

Many scoff at the idea the US dollar could collapse like the Weimar Republic or Zimbabwe.

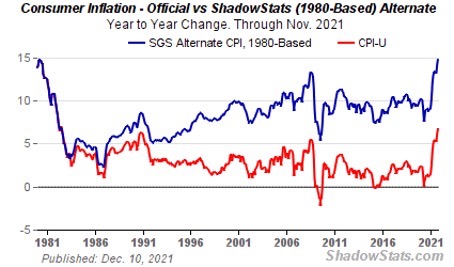

John Williams, www.shadowstats.com calculates inflation using the same manner used during the Carter years. It’s over 14% and has been in double digits for the last few years!

The German Reichsmark lost 99% of its buying power between 1918-1922 – before hyperinflation wiped out what little wealth remained. If the US follows the same pattern, the dollar will be worthless before hyperinflation arrived.

From 1977-1981, accumulated Carter year inflation was just under 60%. If you bought a $20,000 car on 1/1/77 and prices rose equal to the inflation rate, that same vehicle would cost $31,984 in 1982. How are retired baby boomers going to survive if the current inflation continues?

Cash and fixed income investments are guaranteed losers when it comes to inflation. Gold, real estate and stocks appear to be the remaining options.

In the January issue of The Dividend Hunter, expert Tim Plaehn tells us, “As I write this a few days before Christmas 2021, the Stable Dividend and Variable Dividend categories posted year-to-date total returns of about 20%. The Individual Preferred Stocks have earned their average yield of about 7.3%.”

Historically stocks with high yield dividends are considered risky, having to pay high dividends to attract capital. Tim also discusses, “avoiding high-yield traps.”

I contacted Tim; we need his insight going into 2022. Inflation is not going away anytime soon.

DENNIS: Tim, thank you for taking the time for our reader’s benefit. Before I get into the details, let’s start with the major premise.

Neither political party wants to curtail government spending or reign in the Fed buying public debt, causing interest rates to rise to free market levels. What they promoted as “temporary” in 2008, is now the new norm; true negative interest rates.

Do you see the government/Fed doing anything meaningful to reign in inflation?

It looks like stocks, real estate and gold are the primary options left for investors to maintain their wealth. Am I missing something?

TIM: Hi Dennis, if inflation continues unabated, at some point the Fed will need to raise interest rates. My fear is they are so tied to low rates to support government spending and the stock markets, that they may delay rate increases until inflation gets much further out of hand.

They may go through window dressing; small, incremental rate increases, hoping to bring inflation down, but I doubt it will be very effective. I expect the Fed will quickly reverse gears on rate increases if they see the stock markets react negatively.

Delaying will make the pain (to our portfolios) much greater than if they would bite the bullet now and start increasing interest rates. The reality is that meaningfully higher interest rates to curb inflation are probably more than a year out in the future. We have to live and invest with the hand we are dealt.

You are correct to single out stocks, real estate and precious metals. However, those are very broad categories with lots of ways to invest, resulting in a broad range of risk vs. rewards expectations.

DENNIS: This reminds me of the Ford presidency with his silly WIN buttons. He encouraged personal savings and disciplined spending habits.

ZeroHedge reports, “Shocking Consumer Credit Numbers: US Credit Card Debt Soars Most On Record With Savings Long Gone.” Ford was ineffective. By delaying, as you suggest, Paul Volcker had to dramatically raise interest rates to bring inflation under control.

OK, we can’t change the game, then our option is to learn to play well or see a terrible loss in the buying power of our life savings.

Your performance last year was terrific. What do you look for that is safe, yet giving investors the opportunity to keep up, or beat inflation?

TIM: Unfortunately, without higher interest rates, it becomes a tougher challenge to find “safe” inflation-beating investments.

I continue to recommend that a diverse portfolio of higher yield income securities is the best way to have good portfolio performance through all market cycles.

What companies and industries can survive and thrive during times of high inflation? Think about rising costs and then invest in companies that can more easily pass along their inflationary increases. It is not always easy; price increases can also mean losing customers.

Apartment REITs quickly come to mind, but other types of property REITs should have pricing power.

Upstream energy producers should do very well. I like the new trend of dividend payouts directly correlated to profits, such as the new dividend policy of Devon Energy.

DENNIS: You mentioned companies that are likely to increase their dividend. I know the oil industry isn’t shy about regularly raising gas prices. Oil companies have a history of staying ahead of the game, raising prices more than the inflation rate.

GE was a client of mine and Jack Welch used to preach that “if you pass through inflationary increases, you will always be behind. You have to be proactive and stay ahead of the increases.” Easy to say, but tough to do for a lot of businesses. It must be difficult finding companies or industries that can easily pass along their inflationary cost increases to consumers.

TIM: The easy path is to back into the answer. Look for companies with histories of growing their dividends. Then review the business operations and look for any reasons they would not be able to pass along higher costs. A company will not absorb higher expenses without increasing what they charge unless something prevents them from doing so.

It takes a lot of time, research and digging, but there are opportunities out there. For every candidate I find, there is a lot more research taking me to the conclusion that I will pass on investing in this company.

As you mentioned, for a lot of companies, inflationary times are a great opportunity to expand profit margins.

DENNIS: You mentioned, “avoiding high yield traps”. What are the traps, how do you separate safe from risky?

TIM: A stock gets a high yield because the “market” believes the dividend is at risk. You end up with a binary outcome. Either the market is wrong, and the dividend is secure and investors benefit from earning the higher yield. Or the market is correct, and eventually the dividend gets reduced.

A high yield focused investor must be able to dig into how a company generates cash to pay dividends and determine if the cash flow is sustainable.

When we had the corrections a few years ago the market reacted emotionally, stock prices dropped dramatically, and we jumped in and bought. Many of our gains in 2021 were from that quick action. More will arise, we need to be patient, continue doing our homework, and be ready to take advantage of the opportunities.

DENNIS: You believe in holding some cash reserves to be able to take advantage of those bargains. I look at our current cash holdings and shudder to realize we lost 14% of that buying power over the last year. With current double-digit inflation, have you changed your guidelines?

TIM: Nope. My recommended “dry powder” holdings are 5% to 10% of a stock portfolio. If the rest of the portfolio generated 20% plus total returns, the overall portfolio is doing fine.

When the market corrects, that “dry powder” will be put to work generating wealth from the next market recovery.

DENNIS: One final question. You also mentioned speaking at the Las Vegas money show in February. What are the topics you plan on covering?

TIM: Right now, I am scheduled for two presentations. One will be on what we discussed here, “Avoiding High-Yield Traps and Instead Building a Quality High-Yield Portfolio”. The other is on one of my favorite investment ideas for the next three-to-five years: “Covered Call ETFs: The Pros and Cons of These High-Yield Funds”.

Thank you for the opportunity to address your readers.

Dennis here. If any readers are heading to the show, be sure to catch his presentation and say hello.

The Fed’s choice

The Federal Reserve can protect the stock market and their member casino banks – or – protect the value of the dollar. They pretend to be concerned about both, but their behavior says otherwise. I don’t see inflation being realistically addressed – yet! Meanwhile investors must stay proactive, while seeking out safe, inflation beating income.