Dear Reader,

Last week, the CPI inflation was released, showing the highest year-over-year inflation in 30 years. After living and investing in a low-inflation economy for a couple of decades, investors now need to pick some inflation-fighting stocks and funds.

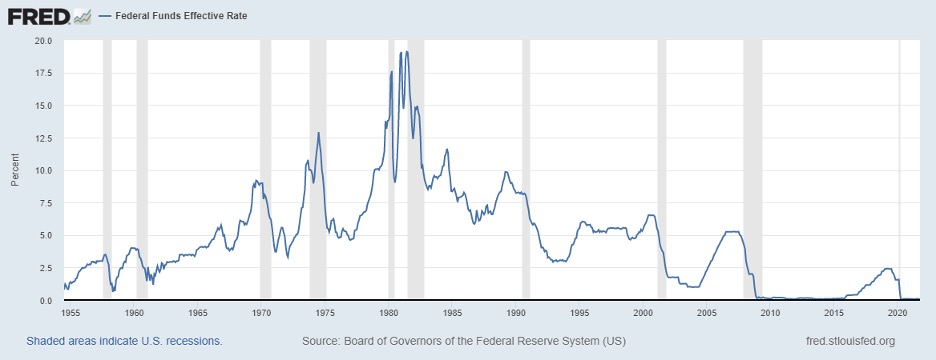

In the 1980s, the Federal Reserve killed inflation by quickly and massively increasing interest rates. High-teens interest rates in the early 80s killed off the inflation of the era. We now live in a time where the Fed is very reluctant to push rates higher. Not only that, but because the Fed Funds rate has not been above 2% since 2008, I am not sure they understand the effects of increasing interest rates. The Fed Funds rate currently sits at 0.8% percent – not much inflation-fighting there.

It is possible that the Fed may procrastinate raising rates to fight current inflation and may be forced to be even more aggressive in 2022 and 2023 when it becomes apparent that trying to talk down inflation does not work.

However, trying to predict actions is like trying to time the next Ice Age. It’s impossible to put a date on those events. Let’s talk about some investment themes and ideas that should outperform if inflation stays high.

For these examples, I use representative ETFs. The funds will work fine. However, I dig out the individual stocks from each sector with the best investment potential for my newsletter subscribers. My model portfolios for subscribers regularly outperform the broad market indexes and ETFs.

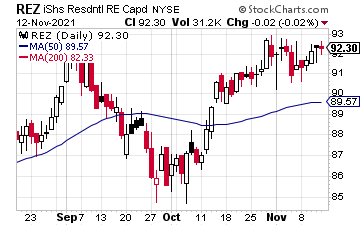

Rents for apartments and homes continue to rise at a record pace. As a result, REITs focusing on multi-family or single-family rental properties should increase revenues and grow dividends. The iShares Residential and Multisector Real Estate ETF (REZ) should continue to post

attractive returns. 2021 year-to-date, REZ is up 35%.

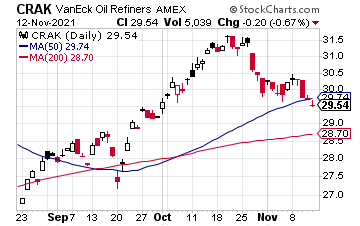

Over the last year, prices for gasoline and other fuels have skyrocketed. Fuel refiners are one sector that will benefit from the currently high (and potentially even higher) energy prices. Look at the VanEck Oil Refiners ETF (CRAK) as the way to invest in oil refining companies. CRAK is up 64% over the last year.

If interest rates are allowed to go much higher, there will be potential again to earn acceptable yields from bonds. You can put together an old-fashioned bond ladder using the Invesco BulletShares ETFs. BulletShares are a series of bond ETFs with fixed maturities from one to ten years. The funds cover both investment-grade and high-yield bonds.