The stock market’s daily movement has begun to normalize, at least compared to March. The major stock indexes are moving about 2% per day on average, significantly higher than what we’ve become used to. Keep in mind: it’s far more typical to see daily moves of 1% or less.

Of course, a market crash will have that kind of impact. Investors will eventually forget how bad March was for most stock prices—but not yet. For now, there is still something akin to caution in the financial markets.

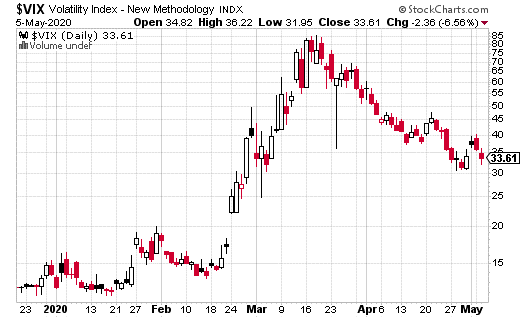

The VIX, an index measuring expected market volatility (based on S&P 500 options prices), remains substantially elevated compared to its normal levels. During stable market conditions, the VIX tends to be below 15. In March, the index climbed above 80. It has yet to drop below 30 since then.

In other words, investors are still feeling the sting from March’s 30% swan dive in stocks. And, it seems they are still concerned about protecting their portfolios. (The VIX is essentially a measure of the cost of portfolio insurance using options.)

The thing is, no one really has any idea what will be the true impact of the coronavirus pandemic and COID-19 infections on the global economy. We also don’t know how long the pandemic will last. Indeed, there will likely be waves of infections, just like with the Spanish Flu in 1917-1918. How damaging economically each wave will be remains to be seen.

And lest we forget, the U.S. also has a presidential election in November. That event in itself would be enough to justify higher volatility. Throw the election in with a global pandemic and negative oil prices… well, you can see why volatility may remain elevated for quite a while longer.

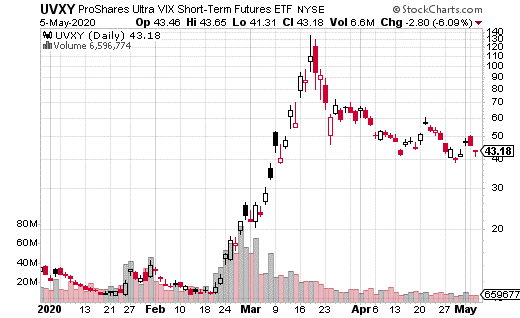

In fact, options action in ProShares Ultra VIX Short-term Futures ETF (UVXY), suggests volatility will remain at higher-than-typical levels for at least the rest of the year. ProShares Ultra is a leveraged exchange-traded fund (ETF) that tracks the first two futures, which make up the VIX term-structure. Basically, it tracks short-term volatility, but uses 1.5x leverage.

With ProShares Ultra trading at $43, a trader was actively selling the December 20 puts for an average price of $4.50. The trader executed around 1,000 of these short puts. That’s about $450,000 collected in premium, which will be kept in full if the stock remains above $20 at December expiration.

The trade can’t lose money at expiration if UVXY closes over $15.50. If this is a cash-secured put, then the trade requires $2 million in cash collateral. That works out to a yield of 22.5% in about seven months. That’s a very nice yield if you believe volatility is going to remain at least somewhat elevated before December expiration…and frankly, given everything going in the world right now, it seems like a pretty savvy bet. As an alternative, a trader could take a lesser yield and put up far less money in collateral by using a credit put spread instead of cash-secured or naked puts.