The Hartford Insurance Group (HIG) has declared a dividend of $0.325 per common share for shareholders of record on June 1st. Currently, the company has a dividend yield of 3.3%.

HIG recently announced earnings, they cited the fact that Hartford had returned $258 million to shareholders in the first quarter. $108 million of that total was paid in dividends, with the remainder being used for stock repurchases.

Earnings for the quarter came in at $1.34 per share, 4% lower than the year-over-year quarter. HIG attributed lower earnings to a variety of factors, with the majority of the drop attributed to a loss in the company’s investment portfolio.

Additional pressure came from higher operating costs and expenses associated with the Hartford’s response to the COVID-19 pandemic.

Addressing the pandemic, Doug Elliot, President of The Hartford further stated, “[T]his crisis has challenged all aspects of daily life with wide-ranging impacts to our stakeholders. We have adjusted operational policies to help agents and customers adapt to the financial effects of this pandemic…”

The company said middle market pricing remained strong in the quarter, with rates increasing 9.4%, and accelerating during the quarter. Margins also improved in Hartford’s Global Specialty business, as increases in renewal pricing supported margin expansion.

Chairman and CEO Christopher Swift said the company was prepared for a successful year, and then pivoted due to COVID-19, but still finished the quarter strong. Swift said, “We entered 2020 in a position of strength, focused on execution to build on the momentum in our businesses. In the first quarter we generated an industry leading twelve month ROE on core earnings of 13.3 percent.”

Hartford Insurance Group said the underwriting impact of COVID-19 was approximately $50 million in the quarter. This included higher short-term disability costs, as well as additional costs due to a change in New York state law aimed at addressing the crisis.

While the company has $650 million remaining on a share repurchase authorization by the board, Hartford announced they would be pausing the buyback at this time, due to unforeseeable risks associated with the current health crisis.

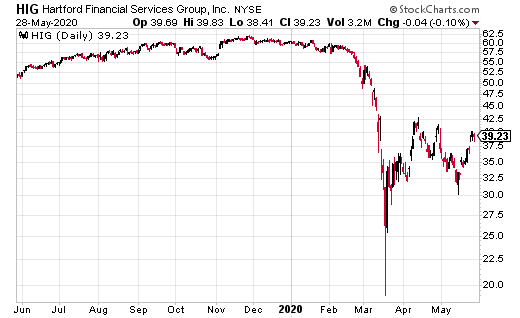

The company’s stock retreated after earnings, but has since regained ground to trade around $40, where it was prior to earnings. Hartford is trading down from the $60 range prior to the onset of COVID-19.

Steven Adams’s personal position in Hartford Insurance Group: none.