Dear Reader,

Recent earnings coming out of the retail sector show how important management decisions have become in this era of supply chain challenges and high inflation.

Stocks have stopped moving in tandem with their peers. Those who can pick the best companies, with the best management teams, as their investments will significantly outperform the indexes.

Let’s look at the results from two competing retail companies.

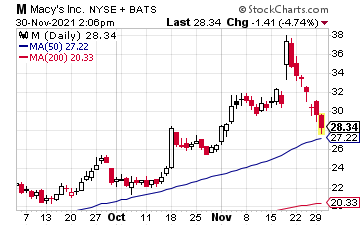

On November 19, Macy’s Inc. (M) reported earnings that smashed Wall Street estimates. The non-GAAP EPS of $1.23 per share beat the analyst consensus by a whopping $0.90, or 200%. Macy’s share price quickly jumped by 22%. Investors believed in the Macy’s story all year, with the stock up 200% year-to-date.

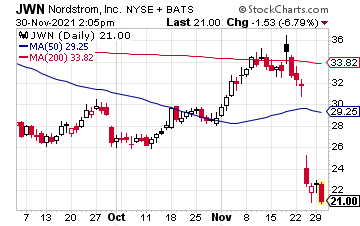

On November 23, Nordstrom (JWN) missed big on earnings, reporting EPS of $0.39 per share, compared to the Wall Street consensus of $0.56 per share. One big issue was that Nordstrom did not – or could not – pass along price increases at its Nordstrom Rack discount stores. The company reported earnings after the market closed, and on November 24, the stock price dropped by 30%. Yes, a one-day 30% decline!

This type of disparity between companies in the same business sector has shown up throughout the earnings season. Picking stocks just because they are in a hot industry, such as retail, during the holidays won’t work.

You need to choose the companies that successfully navigate the supply and inflation challenges and avoid those that don’t.

Dividend growth can be a good starting metric when trying to pick winners and avoid losers.

In my Monthly Dividend Multiplier service, I shoot for above-average long-term returns by recommending a portfolio of dividend growth stocks. That means companies that don’t necessarily have high dividend yields right now – but are likely to increase those payouts soon.

By getting in before the dividend payouts grow, you get that future yield for cheaper – and you get a nice boost to the stock price to boot.

To see the power of this strategy for yourself, take a look here.

Over the past two years, many companies have throttled dividend increases, waiting for the economy to come out of the pandemic. I have stayed patient with companies and stocks that historically put up above-average dividend growth numbers.

That will change in 2022. I will not continue to recommend or invest in stocks that don’t announce meaningful dividend increases.

Growing dividends is a great way to tell if a Board of Directors and the management cares about investors. It also shows that revenues, EBITDA, and profits are on the right trajectory.

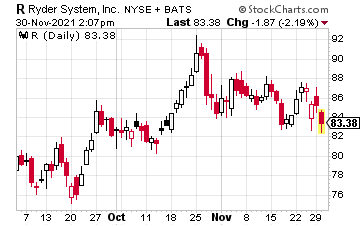

Ryder System, Inc. (R) is a company right in the middle of the supply chain. Ryder’s business segments include transportation logistics, supply chain solutions, and truck leasing & maintenance. Historically, the business cycles are correlated with used truck prices. Everything lines up for Ryder to have a great 2022.

Ryder historically increased its common stock dividends by 8% to 10% per year. There was no increase in 2020 and a small 3.5% increase in 2021. Ryder has paid a dividend for 181 consecutive quarters.

So I look forward to a very nice (around 10%) Ryder dividend boost next year.If you want to get in on even higher dividend increases, join me in Monthly Dividend Multiplier by clicking here.