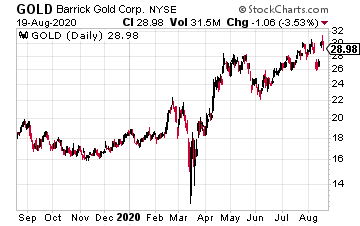

Barrick Gold Corp. (GOLD) rallied above $30 a share, as gold spiked above $2,000. Helping, Warren Buffett’s Berkshire Hathaway bought shares of Barrick Gold.

“In the past, Buffett, the billionaire chairman of Berkshire, cautioned against investing in the metal because it’s not productive like a farm or a company. Now, gold miners are benefiting from surging bullion prices that are boosting profit margins as costs of production have steadied, making them increasingly attractive investments. Large miners including Barrick and Newmont Corp. have been hoping to woo back generalists who fled the sector years ago,” says Bloomberg.

Plus, “As economic output contracts sharply, fiscal outlays surge, and central bank balance sheets double, fiat currencies could come under pressure investors will aim for gold,” argue analysts at Bank of America.

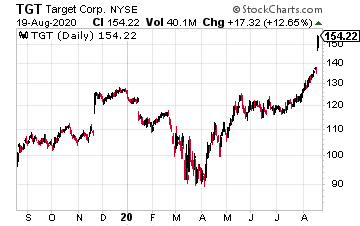

Target Corp. (TGT) rallied to $145.23 on blow-out earnings. Its adjusted EPS was up to $3.38, as compared to expectations for $1.62. Revenue of $23 billion was above estimates for $20.09 billion. And same-store sales soared 24.3%, as compared to expectations for 7.6%.

“The company’s online offerings were especially popular. For example, sales through Target’s curbside pickup service, Drive Up, shot up by more than 700% in the second quarter compared with the same time last year. Target sales fulfilled by its online delivery service Shipt grew more than 350% year-over-year,” reported CNBC.

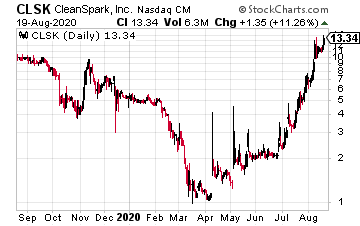

Shares of CleanSpark Inc. (CLSK) jumped above $12 from a recent low of $10.92. All on the popularity of microgrids with recent blackouts and heat ravaging California. Even nations around the world are increasing their deployment of microgrid technology. In the U.S., for example, lawmakers could be a major catalyst for microgrid technology. In fact, many are starting to incorporate microgrids into their climate strategies. Plus, up to 44% of businesses are considering using microgrids, according to a recent Deloitte report.

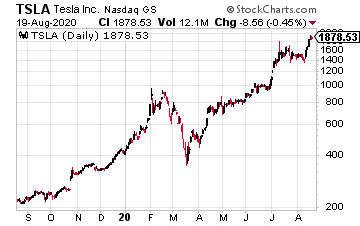

Tesla Inc. (TSLA) crossed $1,900 a share days before its expected 5:1 stock split. Wedbush analyst Dan Ives raised his price target to $1,900 on signs of accelerating demand in China. “We continue to believe [electric vehicle] demand in China is starting to accelerate in July/August with Tesla competing with a number of domestic and international competitors for market share with Giga 3 remaining the linchpin of success which remains the prize that [Chief Executive Elon] Musk and Tesla are laser focused on capturing,” he said, as quoted by MarketWatch.

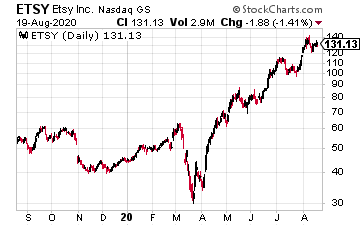

Etsy Inc. (ETSY) is still running to higher highs, last trading at $133 a share. Just weeks ago, the company posted a five-fold increase in earnings. It earned $96.4 million, or 75 cents a share, up from 14 cents a share year over year. Revenue was up 137% to $429 million. Analysts were only looking for 39 cents on sales of $330 million.

As of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.