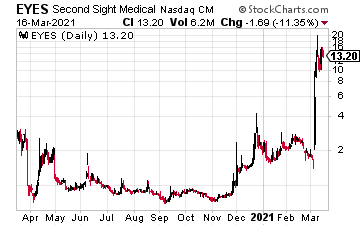

Second Sight Medical Products (EYES) exploded from a low of $1.40 to $20 this week before retreating to around $11.00. All on news the U.S. FDA approved its Argus 2s Retinal Prosthesis System.

According to EYES, the System is, “a redesigned set of external hardware (glasses and video processing unit) initially for use in combination with previously implanted Argus II systems for the treatment of retinitis pigmentosa (RP). The Company expects that the Argus 2s will be adapted to be the external system for the next generation Orion Visual Cortical Prosthesis System currently under development.”

Also, according to acting EYES CEO, Matthew Pfeffer, “We are very pleased to have received this approval, as it presents an opportunity to offer external hardware that we believe enhance comfort and aesthetics compared with the legacy Argus II system.”

Cryptocurrency mining stocks like Canaan Inc. (CAN) and Riot Blockchain (RIOT) saw a good deal of interest over the last few days. All as cryptocurrencies, like Bitcoin, continue to push to higher highs. As of Wednesday morning, Bitcoin rallied to $56,129. Most impressive, MicroStrategy CEO Michael Saylor says Bitcoin could eventually have a $100 trillion valuation.

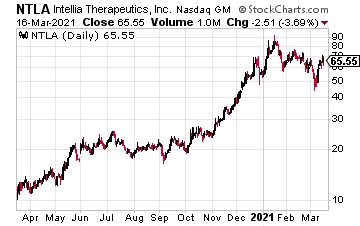

Intellia Therapeutics Inc. (NTLA) gained more than 23% of upside this week. On Wednesday, the company “announced the presentation of preclinical data establishing proof-of-concept for non-viral genome editing of bone marrow and hematopoietic stem cells (HSCs) in mice. This represents the company’s first demonstration of systemic in vivo genome editing in tissue outside the liver using its proprietary non-viral delivery platform.”

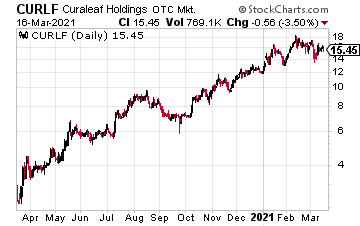

Curaleaf Holdings Inc. (CURLF) was up 16% after agreeing to buy Emmac Life Sciences Ltd. for about $285 million, giving the company entry into Europe’s rapidly growing cannabis market.

“By doing this transaction, Curaleaf is indisputably the largest operator on a revenue and a footprint basis around the globe,” Executive Chairman Boris Jordan said, as quoted in a company press release.

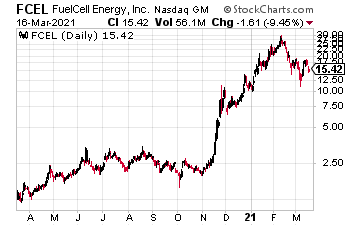

FuelCell Energy (FCEL) is regaining traction as it nears its March 16 earnings date. At the moment, the market is reportedly forecasting 48% year over year sales growth to $22.1 million in revenue. Investors are excited because it appears the company is growing.

At the time of this writing, Ian Cooper did not hold a position in any of the mentioned stocks.