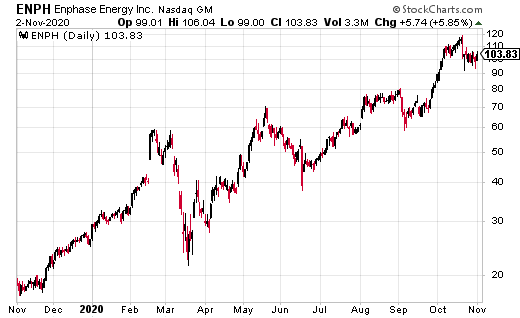

Enphase Energy (ENPH) is another top green stock pushing higher on a potential Biden win.

In fact, since bottoming out around $40 in June 2020, ENPH has exploded to a recent high of $98.09. From here, it could explode even higher ahead of the election.

[insert solar related image we’ve not used in a while; link to CTA link]

Remember, as we noted the other day in an article on SolarEdge (SEDG):

“With increasing investor expectations of not just a potential Biden win but further upside for renewables tied to a Dem sweep at the Senate, we note broader expectations for the solar industry to benefit broadly,” Bank of America strategist Stephen Suttmeier said, as quoted by CNBC. “On a relative price basis we have seen a very bullish rotation for clean energy relative to utilities on an upside breakout from a 9-year big base vs utilities.”

At the moment, green energy stocks, like SEDG and ENPH are attractive on the anticipation of a Biden win. But with this election, there are no clear winners at this point. These stocks are running higher solely on anticipatory momentum, as we’ve also noted.

Related: ENPH Hits 52-Week High On Natura Living Announcement

Helping quite a bit, the company just expanded into the home energy market, and entered into three solar distribution companies in Belgium and the Netherlands, which helps to further strengthen its presence in the European solar market.

Enphase Reported Q3 Earnings

Company EPS came in at 30 cents, beating estimates for 24 cents. Revenue of $178.5 million was a year over year decrease of 0.86%. However, it still beat estimates for $168.5 million. For Q4 2020, the company forecast revenue to fall in a range of $245 million and $260 million.

According to President and CEO, Badri Kothandaraman:

“Demand for our core microinverter products rebounded strongly in the third quarter of 2020. We experienced record sell-through from distribution to installers, resulting in channel inventory slightly below the low end of our typical target range. Sales to distributors improved significantly and was broad-based geographically. We were also pleased to report our first quarter of significant revenue from the sale of Encharge storage systems.”

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.