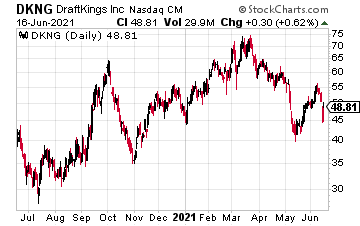

Draftkings Inc. (DKNG) is beginning to recover after a short report from Hindenburg Research. The short sellers allege that, “SBTech, a European technology company that merged with DKNG as part of the SPAC deal, generates significant revenue from questionable gambling practices in overseas markets, particularly in some Asian markets,” as reported by CNBC.

However, DKNG did note, “This report is written by someone who is short on DraftKings stock with an incentive to drive down the share price. Our business combination with SBTech was completed in 2020. We conducted a thorough review of their business practices and we were comfortable with the findings. We do not comment on speculation or allegations made by former SBTech employees.”

Roblox Corporation (RBLX) pulled back after reporting that daily active users fell by 1% from 43.3 million month over month. Year over year, that number is up 28%. Hours engaged were 3.2 million, up 9% year over year, and 1% month over month. Plus, revenue is estimated to be between $149 million and $151 million, up 123% to 126% year over year. In addition, Roblox was the top grossing mobile game in the first quarter, according to research firm App Annie.

While there are fears of a gaming slowdown post-pandemic, there are no signs.

Related: Trade of the Week: RBLX

With mobile games, for example, “As the pandemic continues, mobile gameplay is showing no signs of slowing down. Users downloaded 30 percent more games in the first quarter of this year than in the fourth quarter of 2020, before the vaccine rollout, which as App Annie indicates, is over one billion games a week. As mobile games continue to be the primary driver of growth in digital game consumption, the biggest leaps in spending are seen in North America and Western Europe,” as reported by The Hollywood Reporter.

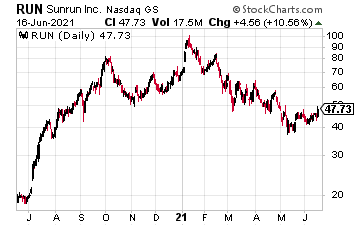

Sunrun (RUN) is pushing higher after analysts at Morgan Stanley raised their price target to $91 from $86 a share. This comes just days after Guggenheim analyst Joseph Osha initiated coverage with a Buy rating and $56 price target. “The company is taking market share and exploiting its growing scale, Osha tells investors in a research note. As the residential solar business grows in size and sophistication, so do the advantages of being big, and Sunrun is leveraging those advantages, says the analyst. He expects cash to be returned to shareholders in increasing amounts as the company continues to grow,” as reported by The Fly.

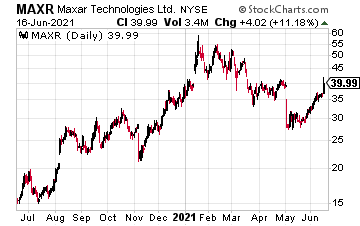

Maxar Technologies (MAXR) is taking off after Goldman Sachs initiated coverage with a buy rating, believing the stock could see 45% upside this year. “We think MAXR has a gem business in earth intelligence and a turnaround opportunity in Space Infrastructure,” Goldman Sachs analyst Noah Poponak said, as quoted by CNBC, adding that the firm sees Maxar as a “great long-term opportunity in the space market.”

At the time of this writing, Ian Cooper did not hold a position in any of the mentioned stocks.