The outbreak of coronavirus in the U.S. has led to the shutdown of a large portion of the U.S. economy. For income-focused investors, the big question is whether dividend-paying companies will sustain or cut dividends.

For industries that are shut down due to government restrictions, a big question is how much federal money they receive and how fast. These are businesses where conserving cash until there is a return to normal business conditions.

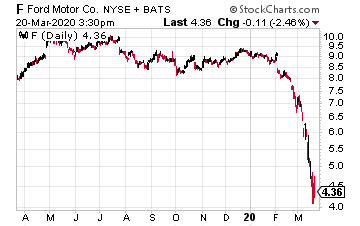

I expect business conditions to return to normal in two to three calendar quarters, so dividend cuts or suspensions should be temporary. Ford Motor Company (F) is a good example. The company is shutting down assembly plants and has raised $15.4 billion in cash from its existing lines of credit. I was going to include Ford as a company where I expect a dividend reduction. The company beat me to the punch, and on March 19th, Ford announced it suspended its attractive dividend.

Another scenario involves companies where the business continues to produce enough cash flow to support the dividend. Still, the share prices have fallen so far that dividend yields look, frankly, crazy.

Consider EnLink Midstream (ENLC) which will sustain revenue and cash flow to cover the $0.75 per annual share dividend handily. Yet the stock price is trading for less than $1.50, giving a 50% dividend yield. I could see the ENLC Board of Directors deciding to reduce the dividend and use the cash to pay down debt. EnLink is an extreme case, but there are lots of companies with what should be stable dividends priced to yield 20%, 30%, or higher.

This Plan Can Pay Your Bills For a Lifetime… Even During Downturns

Here are three stocks where I expect to announce dividend reductions or suspensions soon.

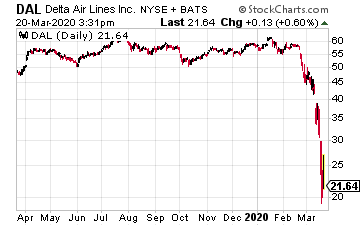

It’s easy to understand that the airlines are in trouble. They will very likely get billions in financial help from the federal government, but I don’t know if the Feds will also let them continue to pay dividends.

Delta Airlines (DAL) has increased its dividend for six straight years.

With the recent share price drop, Delta shares now yield 7.2%. I think that the attractive yield will soon be history.

With passengers canceling flights and entire routes being canceled Delta’s already storing perfectly good airplanes in the desert to ride out this downturn.

Expect Delta to cut or suspend its dividend before the next regular dividend announcement date in late April.

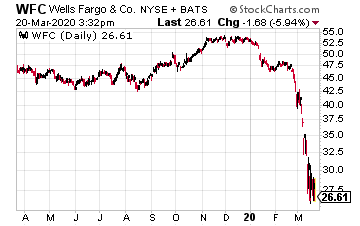

Over the last several years, of the large, money center banks, Wells Fargo & Company (WFC) has faced the most turmoil.

The biggest scandal was opening new accounts for customers without their permission.

Lower interest rates and credit market volatility will put a big dent in bank profits. Wells has a new CEO, and I expect he will bite the bullet and use the current crisis as a reason to cut the dividend.

The WFC dividend has increased for nine straight years since coming out of the financial crisis.

The current yield is 7.25%. It’s not a yield to chase.

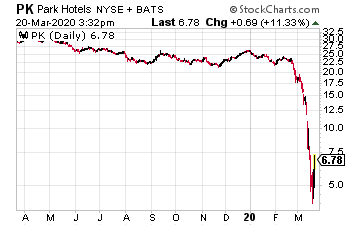

Lodging REIT Park Hotels & Resorts (PK) reduced its dividend in February but is still priced to yield 29%.

Lodging/hotel REITs are the one type of real estate investment trust that participates in the financial results of the hotels they own.

The hotels are typically run by hotel company operators such as Hilton and Marriott.

The hotel industry is shut down by the coronavirus pandemic, and the sector should receive financial help from the federal government.

However, to make a recovery work, I expect most of the lodging REITs to suspend dividend payments for a short time.