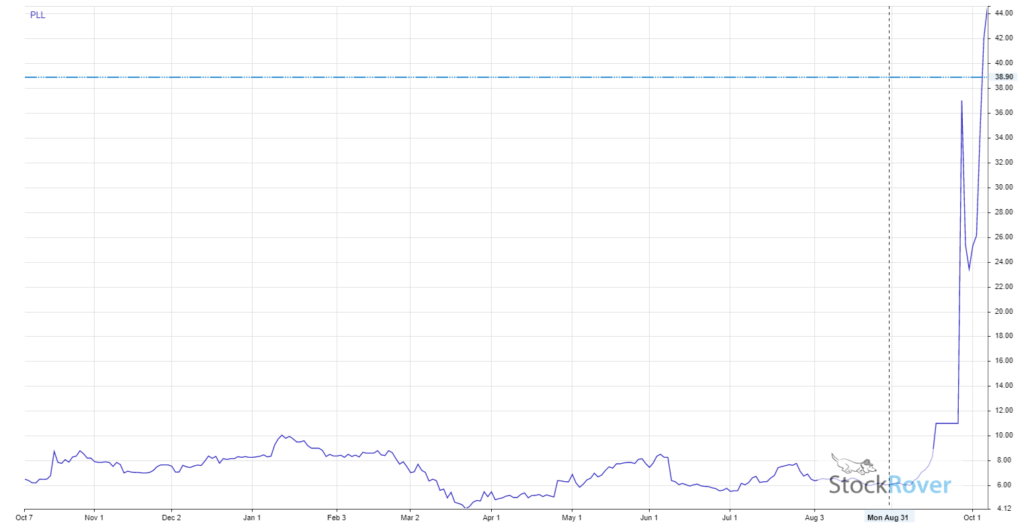

Shares of Piedmont Lithium (PLL) exploded again to a high of $49.95 after trading at just $8.79 in mid-September 2020. The stock is still running after signing a deal with Tesla to help secure lithium supply. “The deal is for five years of lithium-ore supply with an extension for another five years. Deliveries are expected to start in 2022,” according to Barron’s.

Shares of Alteryx Inc. (AYX) soared 28%, or $32 a share after it raised third quarter guidance, and named a new CEO. AYX now expects to see third quarter revenue in a range of $126 million to $128 million, up 22% to 24% year over year. Analysts were only expecting $113.5 million. In addition, AYX said that co-founder and CEO Dean Stoecker will be replaced by Mark Anderson, who already sits on the board of directors.

“In our opinion, Mr. Anderson brings extensive experience in sales and marketing, including driving growth at several large public software companies,” Needham analyst Jack Andrews said, as quoted by Investors’ Business Daily.

“We view Anderson as a huge credibility shot in the arm to Alteryx after a shaky second quarter, with his stellar track record and strong Street reputation now front and center for investors,” added Wedbush analyst Dan Ives.

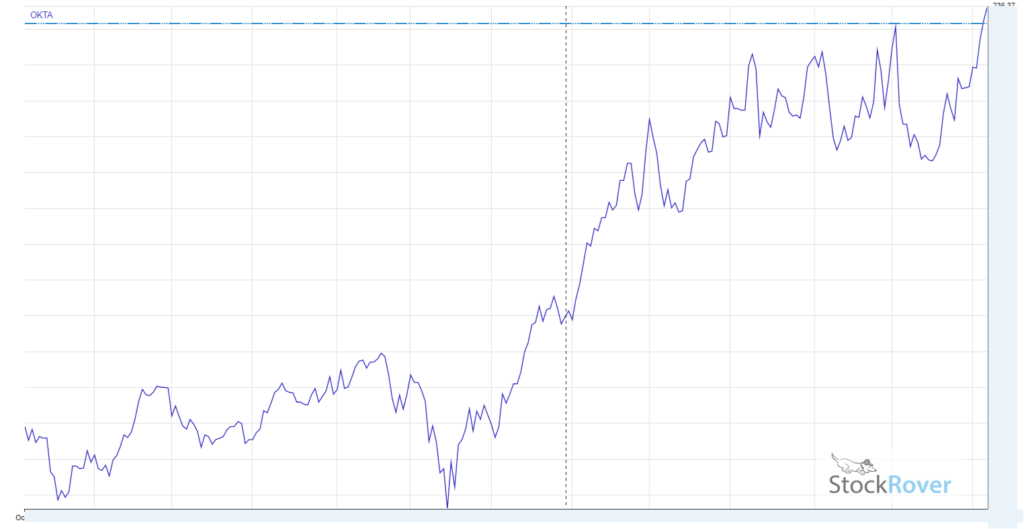

Shares of Okta Inc. (OKTA) are up more than $10 this week on news it and Salesforce (CRM) announced a partnership and new integration between the Okta Identity Cloud and Salesforce Work.com designed to help organizations and communities build trust with their employees and customers, according to its latest press release.

“Okta is the identity company that stands for trust, and that has taken on new weight during the pandemic. We’ve helped organizations move to remote work and keep their people employed and productive, even when they can’t be in an office. We’re also giving organizations the solutions and tools to build secure, seamless customer experiences, empowering them to still generate revenue and drive growth,” said Todd McKinnon, Chief Executive Officer and co-founder, Okta. “We take our responsibility as a business enabler seriously, and so does Salesforce. We look forward to partnering closely to provide our customers with secure, delightful experiences so they can safely and effectively engage with their communities.”

Shares of OPKO Health (OPK) is picking up a good deal of momentum, as markets wait for news on its Phase 2 data on rayaldee, a potential treatment for mild to moderate COVID-19. The company expects to report its data before year end. “The trial will be conducted at multiple COVID-19 outpatient clinics in the U.S. The initial sites are located primarily in South Florida, the Central Gulf coast, the Midwest and the Southwest. The first subjects are expected to be enrolled within the next few weeks,” according to the company’s latest press release.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.