Travelers are taking to the skies again, which means it may be time to buy oversold airline stocks.

About 6.5 million people passed through TSA checkpoints over the last weekend, Barron’s reports. In addition, airline spending jumped 91% year over year in March. As Bank of America analyst Andrew Didora recently wrote, “We think the March and year-to-date results are impressive given the geopolitical environment and a 36% increase in jet fuel prices since the Russia/Ukraine conflict began and speaks to the strong demand environment as leisure and corporate travel return post-Omicron.”

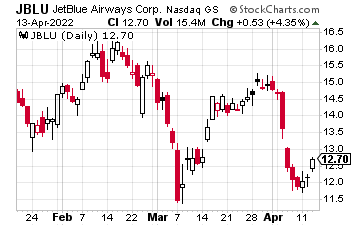

Look at JetBlue Airways (JBLU), for example. After getting crushed by the coronavirus pandemic, the stock is just starting to take flight again. In fact, if you look at the tail-end of the JBLU chart, you can see the stock just caught double-bottom support and is starting to pivot higher. It’s also wildly oversold on the relative strength index (RSI), moving average convergence divergence (MACD), and Williams %R.

It doesn’t hurt that JetBlue was just upgraded to neutral at MKM Partners, with a $13 target. Also, according to analyst Conor Cunningham (as reported by The Fly), bad news has been priced into the stock, and he does not expect to see “material downside” from here.

On top of that, as noted in the company’s fourth quarter earnings report:

While Omicron has temporarily weighed on demand in the very near-term, we expect sequential month-on-month improvement through the quarter, ultimately returning to sustained profitability in the spring and beyond. Furthermore, were it not for Omicron, we believe we would have generated higher revenue this quarter than in the first quarter of 2019,” said Robin Hayes, JetBlue’s Chief Executive Officer.

Not that there hasn’t been turbulence along the way—including a rash of flight cancelations. Reportedly, the company scheduled too many flights but didn’t have enough staff for all of them. Once it can staff up to meet demand, JetBlue could really take off. Right now, all I can tell you is the JBLU is technically oversold, and looks to have a great deal of negativity priced in. From a current price of $12.65, we’d like to see JetBlue stock refill its bearish gap around $14.77 initially. From there, perhaps it can taxi back to $22 per share.