What a difference a vaccine makes! I am talking, of course about how my Dividend Hunter readers—the ones getting an average of 9% yields on our portfolio holdings—feel about their income-focused, stock market investments in light of the good news last Monday about an effective coronavirus vaccine. The news lit a fire under share prices for out-of-favor stocks. It has been a while since I had received the “when do I take profits?” question. Mostly over the last eight months, I have been counseling investors not to sell and to lock in their losses.

In my Dividend Hunter service, the goal is to generate attractive cash income returns from a diversified portfolio of high-yield investments. During the pandemic-triggered stock market crash in February and March, the high-yield investment sectors—all of them—crashed much harder than the overall stock market. Different sectors, from preferred stocks to MLPs, were down 60% to 90% in a matter of weeks.

Over the next several months, let’s say April through October, I was busy evaluating hundreds of dividend-paying investments, and advising my subscribers about what stocks to sell, hold, or buy. It was a time of tremendous fear for many investors, with dividends being slashed all over the place. Our income-focused portfolios were down over 50% from their January levels.

In hindsight, April 2020 may have been the buying opportunity of the decade. It’s a lesson to remember that when we are most fearful, that is the time to commit capital to beaten down, but quality, investments.

Now I am somewhat surprised to be getting emails from subscribers who bought in April, May, and June and are now sitting on gains of 50% to over 100%. The question is whether to sell and lock in the profits or to continue to hold on to the greatly appreciated shares. With income investments, the answer is not an easy one.

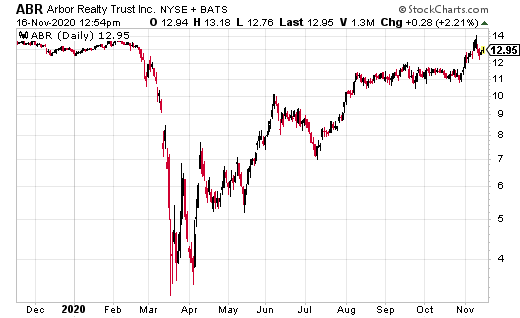

Consider the case of Arbor Realty Trust (ABR). Arbor has been a big winner for my subscribers, both for long-term investors and for those who picked up shares on the cheap during the pandemic market crash.

Instead of cutting dividends, Arbor twice increased its payout over the last nine months. During the crash, the Arbor share price dropped below $4.00, and there was a two-month window to invest for less than $7.00 per share. The stock now trades for $13 and change.

You may be thinking that if I bought at $7.00 and could now sell for $13.00, why wouldn’t I take the 85% profit? The answer concerns the dividends. For the investor with a $7.00 average cost on their Arbor shares, the yield on cost is 18% with a growing dividend. Wow! The current yield is close to 10%, so if shares are sold, the proceeds need to be invested at a yield above 10% to keep the income stream stable and growing.

Whether to take big profits or hold on for great income is a dilemma I am happy to face. It feels a lot better than the decisions required back in the spring. The good news for my subscribers is they are now in win-win positions. They can continue to earn excellent yields on the shares purchased months ago, or they can take profits and find new, possibly more attractive homes for their gains.