My email inbox regularly fills with questions about how to reach a certain level of monthly retirement income. The notes typically come from retired or nearly-retired individuals who realize their retirement savings at the financial advisor-recommended 4% annual withdrawal rate will not produce the amount of income wanted or needed. I want to share one way to generate significantly more than 4% cash income from your retirement savings.

The following example is hypothetical. The strategy employed works, but it is crucial that before you start using it for your own retirement income, you understand the range of potential outcomes and adjust your positions when they don’t work out exactly as planned.

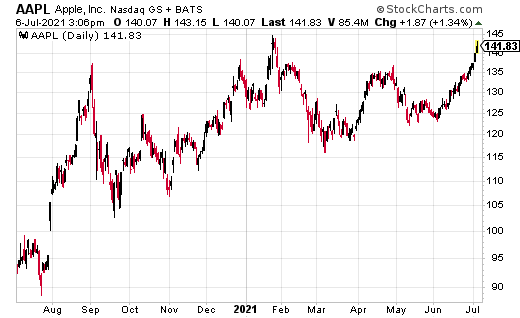

For our example today, let’s assume you have, over the years, acquired a significant number of Apple, Inc. (AAPL) shares. Many investors have done very well with AAPL. The company’s future looks bright, and you don’t want to sell your shares. However, Apple’s less-than-1% annual dividend yield doesn’t go very far toward paying the bills.

To derive more income from your AAPL shares, you can sell call options backed by those shares. The strategy is called covered call trading. Let me illustrate:

Apple currently trades for $123 per share. You want to generate 1% per month of income. At the time of writing, calls that expire in 36 days are trading on the options exchange; looking through the Apple options chain; I see that the $136 strike price calls are priced at $1.35. The option price divided by the stock price gives a 1.1% cash return in 36 days. That hits the 1% per month goal.

You would sell one Apple $136 call for every 100 shares of stock. A 100-share round lot backs each call option contract. In this case, you receive $135 for every 100 shares of Apple you want to commit to your covered call trading program. Selling the call option obliges you to deliver Apple shares if the calls are exercised, which would only happen if the stock climbs to above $136 per share, and you would receive $136 each for your shares.

If Apple remains below $136 when the calls expire, the options expire worthless, and you keep the $135. The next week you can again sell more calls against your Apple shares. You can repeat selling call options every month or so, generating a 10% to 12% annual yield from your shares. Selling calls with strike prices that far above the current stock price makes it unlikely your shares would get called away.

If you had the good luck to have your Apple shares appreciate by 10% in a month, there are techniques you can employ to keep them if you really don’t want to sell at the option strike price.

I hope this example makes sense, and you get the idea of how you can produce a very nice cash income from the stocks you already own.