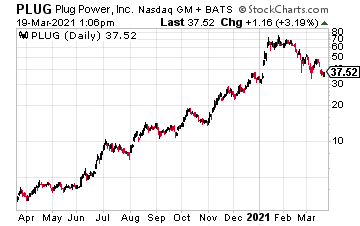

Plug Power (PLUG) pulled back in recent days after announcing accounting errors for 2018, 2019, and for the first three quarters of 2020.

“Anytime a company needs to restate results, investors shoot first and ask questions later,” said Jeffrey Osborne, a New York-based analyst at Cowen, who maintained a buy-equivalent rating, with a price target of $75 for the shares, as noted by Bloomberg. Analysts at B. Riley also see a buy opportunity on the pullback. However, analysts at Truist downgraded the stock to a hold. As also quoted by Bloomberg, “Following these disclosures, we expect limited opportunity for outperformance in the near-term. While the company reiterated long-term targets and the accounting issues appear transitory in nature, we see limited upside until resolution.”

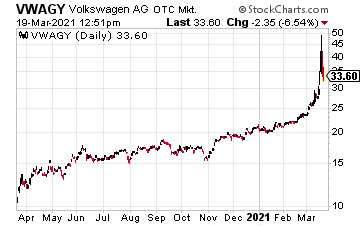

Volkswagen AG (VWAGY) continues to push higher with its electric vehicle plans.

In fact, “VW aims to become the global EV leader by 2025 at the latest, though reaching its target of 1 million deliveries this year could put the company ahead of Tesla. Those big ambitions appear to be getting the attention of retail investors who have bid up U.S. stocks speculated about on Reddit and other social media forums early this year,” added Bloomberg.

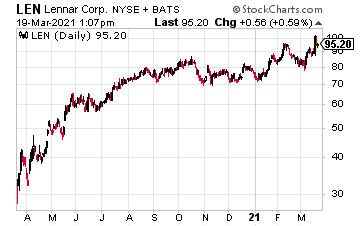

Lennar Corp. (LEN) soared earlier this week on solid first quarter numbers.

“Our first quarter results benefited from continued robust market conditions, combined with the exceptional performance of our core homebuilding and financial services businesses,” executive chairman Stuart Miller said in a release, as quoted by Barron’s, adding, “the housing market remains very strong across the country. With an excellent balance sheet and continued execution of our core operating strategies, we are extremely well positioned for an even stronger 2021 as the year progresses.”

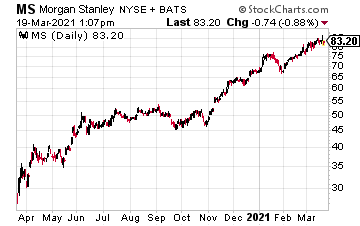

Morgan Stanley (MS) just became the first big U.S. firm to offer clients access to Bitcoin funds.

According to CNBC, “Two of the funds on offer are from Galaxy Digital, a crypto firm founded by Mike Novogratz, while the third is a joint effort from asset manager FS Investments and bitcoin company NYDIG. The Galaxy Bitcoin Fund and FS NYDIG Select Fund have minimum investments of $25,000, while the Galaxy Institutional Bitcoin Fund has a $5 million minimum.”

Food ordering software company, Olo Inc. (OLO) was up more than 20% earlier this week thanks to strength in online ordering. According to CNBC, “The surge in online restaurant ordering during the pandemic helped Olo turn a profit of $3.06 million last year, according to regulatory filings. In 2018 and 2019, the company lost money.”

At the time of this writing, Ian Cooper did not hold a position in any of the mentioned stocks.