There’s a good deal of excitement with mobile gaming stocks, like Zynga (ZNGA).

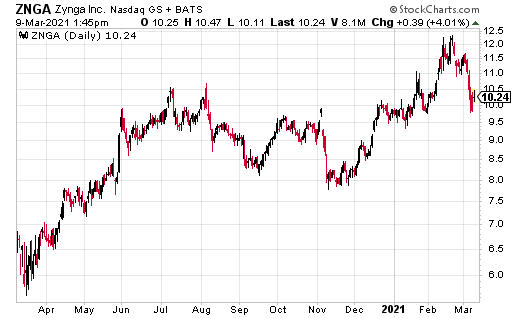

Since late November 2020, ZNGA ran from a low of about $8 to a high of $12.25. It has since pulled back to $10.23, but appears attractive with big catalysts ahead of it.

One, spending on mobile gaming could grow to $120 billion this year, according to App Annie.

Two, mobile gaming is “still bigger than all these other forms of gaming combined, including the console, PC, Mac, and handheld. That is still very true even with the launch of new consoles,” as noted by Venture Beat. “It’s not just young people spending all their time on mobile. In the U.S., Gen Z, millennials, and Gen X/Baby Boomers spent 16%, 18%, and 30% more time per user in their most-used apps in 2020 compared to a year earlier.”

Three, industry giants are acquiring mobile gaming companies.

For example, Electronic Arts announced it would acquire Glu Mobile for $2.1 billion.

“The acquisition will immediately add significant scale to Electronic Arts’ mobile games business. The combination of Electronic Arts and Glu creates a leading mobile product portfolio that includes more than 15 top live services across fast-growing genres with a combined $1.32 billion in bookings over the last twelve months.”

Even better for Zynga shareholders, the company just acquired Echtra Games, a cross-platform game studio composed of a development team whose core members have previously shaped the world of action role-playing games through their work on genre-defining titles including Diablo, Diablo II, the Torchlight franchise, as noted in a recent company press release.

“Max and his team at Echtra Games are responsible for some of the most legendary game properties ever created, and they are experts in the action RPG genre and cross-platform development. I’m excited to welcome the Echtra Games team into the Zynga family,” said Frank Gibeau, Chief Executive Officer of Zynga. “This acquisition will be instrumental in growing our iconic licenses and brands from mobile to PCs and consoles, while helping to further expand Zynga’s total addressable market.”

At the time of this writing, Ian Cooper did not hold a position in the ZNGA stock.