Investors in some of the new breed of ultra-high-yield option strategy ETFs have seen significant share price erosion. I regularly get asked whether the share price can go to zero, and whether the investors in it will lose all their money.

The good news is that the ETFs’ share prices won’t go to zero. The bad news is that NAV/share price erosion is real, and the ETF sponsors must eventually address the low share prices.

A reverse stock split “solves” the problem of a low share price. In a reverse stock split, a larger number of shares is exchanged for a smaller number, with the share price adjusted by the exchange ratio. For example, if the share price is $1.00 and the company declares a 1-for-10 reverse split, the number of shares will decline by 90%, and each share will be worth $10.00. A reverse split does not change the value of an investment.

In November, YieldMax ETFs announced reverse stock splits for 12 of the company’s ETFs, which will take effect on November 28 or December 1, depending on the fund. Five of the funds will have a one-for-five reverse split. The other seven will be one-for-ten reverse splits. Eleven of these ETFs are single-stock covered call ETFs; .the lone more traditional ETF is the YieldMax Ultra Option Income Strategy ETF (ULTY).

ULTY is the ETF I get most questions about. It launched in February 2024 at an initial share price of $20.00. It now trades for $3.98, down 80% from its IPO price. ULTY will experience a one-for-ten reverse split on November 28.

The YieldMax website shows ULTY with a current distribution yield of 80.65%. It’s no surprise that investors are attracted to the massive yield…and then dismayed when they see the decline in the value of their ULTY holdings.

I often tell subscribers to our ETF Income Edge newsletter that they should focus on total returns rather than distribution yield.

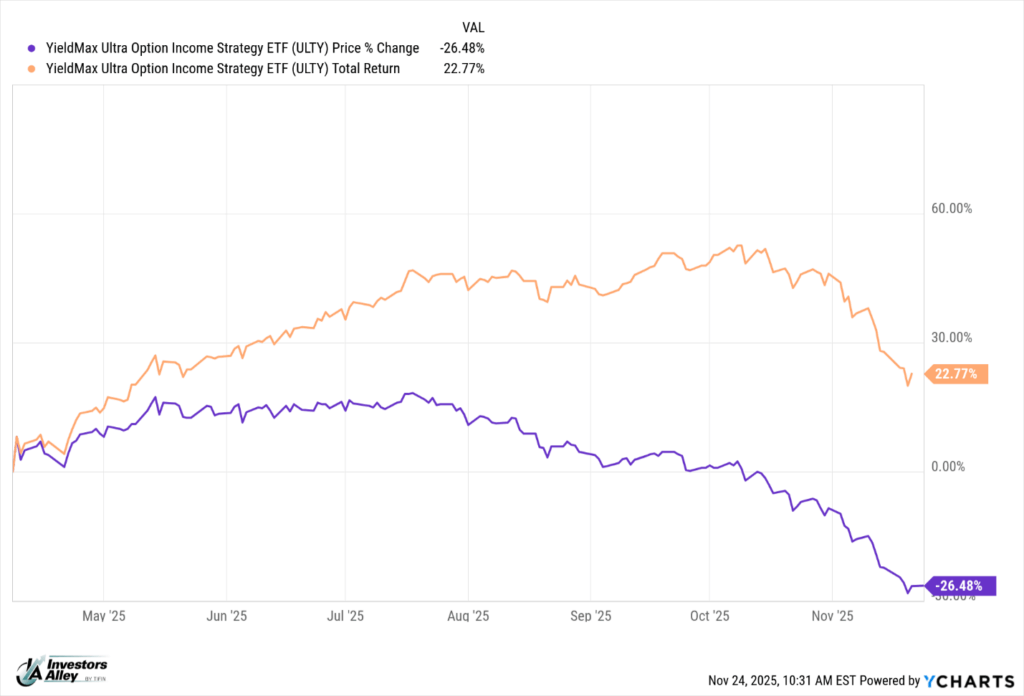

For the most part, the ULTY numbers show an underperforming ETF. Over the last 12 months, the share price has fallen 60%, and the fund’s total return is negative 7.5%. I like to look at returns since April 8, which marked the bottom of the early 2025 bear market. ULTY has returned almost 23% since then.

You can see that a positive total return was accompanied by a 26% decline in the share price.

ULTI’s returns since April 8 are comparable to those of many other option strategy ETFs. However, most investors would likely be more comfortable avoiding deep share price erosion. For example, the REX AI Equity Premium Income ETF (AIPI) returned 38.9% since April, including a 15% share price gain. AIPI still has an impressive 34.8% distribution rate.

The bottom line is that an eye-popping yield is not everything when investing in these high-yield ETFs.

Black Friday Sneak Peek: Lock In 5 Years for the Price of 2

Tim Plaehn here with an advance look at your Black Friday deal: Lock in 5 years of ETF Income Edge for just $1,190—that's 5 years for the price of 2. What you save on this deal could generate $3,570+ in income at 40% yields. Click here.