Fears that a lot of bad debt is lurking in the private lending sector have investors worried about results for business development companies (BDCs). The VanEck BDC Income ETF (BIZD) has fallen 17.5% over the last four months. Even with a double-digit yield, that level of loss is hard to watch.

The business of a business development company is to lend money to small to medium-sized corporations. By definition, BDCs are private debt lenders. One differentiator from the larger companies making private debt loans is that the typical BDC will have customers with moderate-sized businesses, and loan amounts will be relatively smaller.

However, if the trouble with private lending grows, some BDCs will likely be affected. Most BDCs have outside management, and it is conceivable that a BDC sponsor could dump some questionable debt into a BDC they manage.

I like investing in BDC shares. The good ones pay steady, growing dividends and high yields.

First, I generally like to choose BDCs from the handful that are internally managed, as they have much lower expenses compared to BDCs with external managers. Hercules Capital (HTGC) is an externally managed BDC.

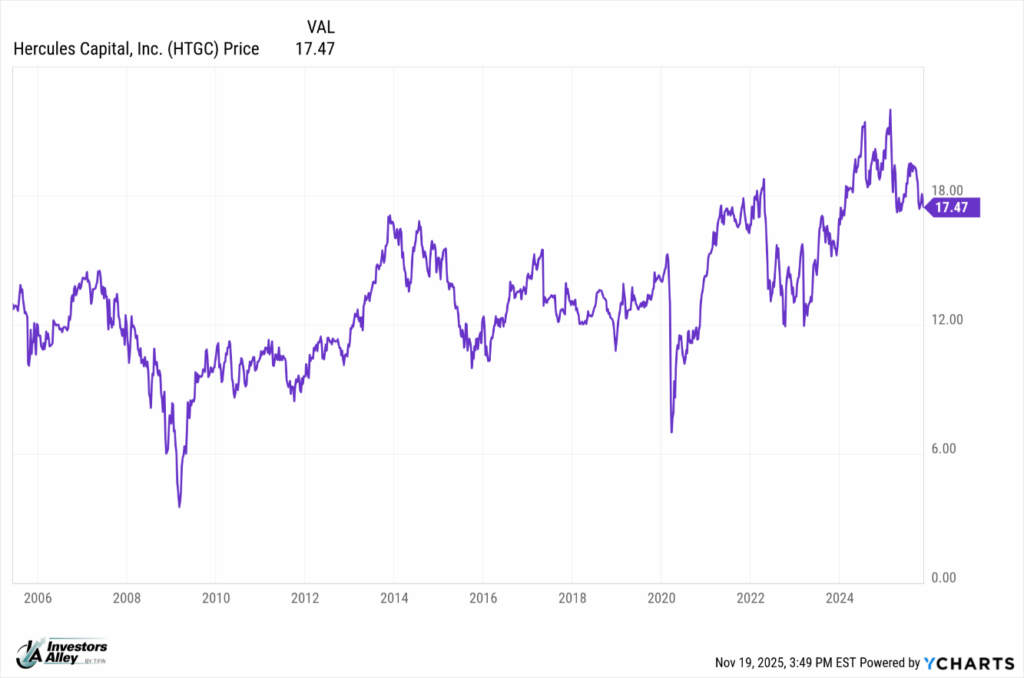

Then look for a company with a long track record. Hercules Capital launched in 2005 and has a 20-year track record, which includes a steadily growing share price.

Finally, a top BDC will have a record of dividend growth. The Hercules Capital dividend has been growing since 2019, with the regular dividend increasing by 29% over that period. Hercules also pays supplemental dividends when justified by profits. Supplement dividends have been paid every quarter since 2021, following the end of the pandemic. The regular dividend was not reduced during the early days of the pandemic. HTGC yields 9.2% on the regular dividend.

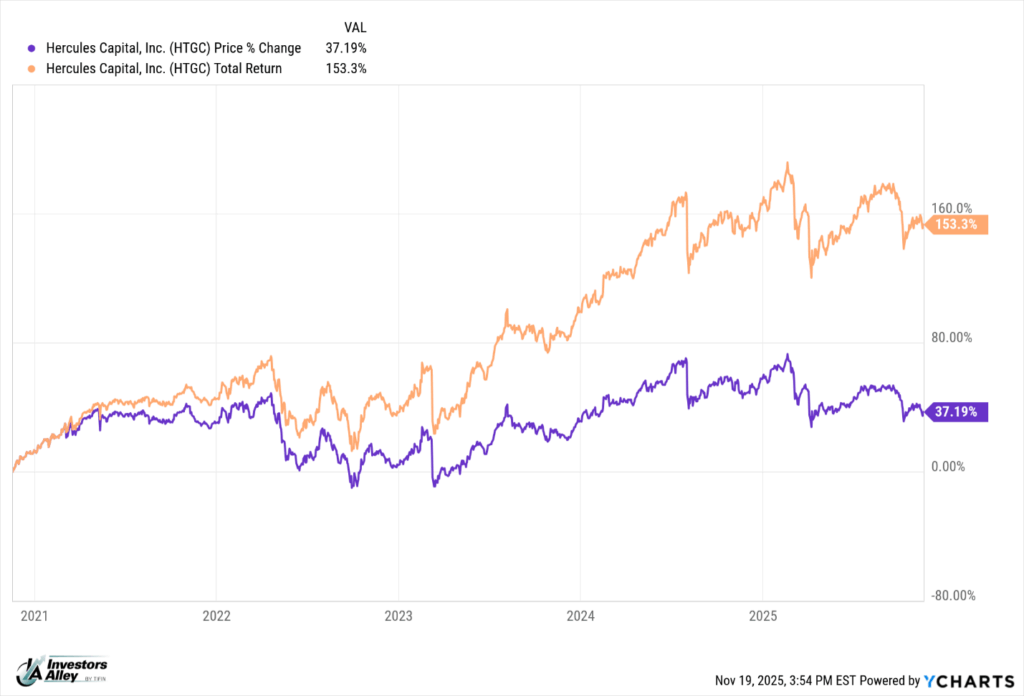

The quality of HTGC is reflected in the returns it pays to investors. The five-year total return sits at 153%.

If I could buy just one BDC, it would be Hercules Capital. It is one of just four I recommend to my subscribers.

Black Friday Sneak Peek: Lock In 5 Years for the Price of 2

Tim Plaehn here with an advance look at your Black Friday deal: Lock in 5 years of ETF Income Edge for just $1,190—that's 5 years for the price of 2. What you save on this deal could generate $3,570+ in income at 40% yields. Click here.