Over the past few weeks, I have introduced my volatility-based indicator and explained how it measures fear and greed in the market, the two forces that drive price action.

This week, I want to go a step further and show how that same indicator helps us stay steady when the crowd reacts to headlines.

Every trading day brings a new reason for investors to feel uneasy. Government shutdowns, geopolitical tension, shifting interest rate expectations, all create the appearance of instability. But when we measure what investors are actually doing, not what they are saying, the picture looks very different.

Investors are still buying dips, rotating capital between sectors, and taking on risk when opportunity presents itself.

That is why my indicator continues to show that we are in an environment of managed emotion—not panic, not euphoria, but controlled uncertainty. This is exactly where disciplined traders find their edge.

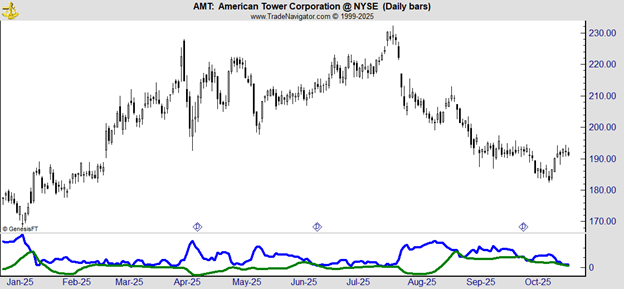

Take our recent trade in American Tower Corporation (AMT) as an example.

After our buy signal triggered on October 2, we entered AMT near the lower end of its recent range. Over the next several sessions, the stock moved sharply, swinging about five percent between its lowest and highest closes. For traders watching those moves in real time, that kind of volatility could have tested confidence.

The news cycle only added to the pressure, with constant reports about rising interest rates and weakness across real estate investment trusts. But our signal never wavered. The indicator continued to show that fear had already peaked and that the decline was driven more by sentiment than by any change in fundamentals.

By trusting the data instead of reacting to each price spike or dip, we allowed the trade the time it needed to play out. Within two weeks, AMT had rebounded more than five percent from its lows and reached our exit signal. It was not a dramatic win, but it was disciplined and repeatable—the kind of outcome that compounds steadily over time.

This trade was a clear reminder of why we rely on the indicator. It identified when fear had peaked, when to act, and when to step aside. Emotionally, the market felt chaotic; technically, it was orderly.

It is easy to get caught up in the narrative that everything is uncertain. But uncertainty is constant. What matters is how emotion is priced and when it shifts. That is what the indicator measures. It quantifies when fear has run its course and when greed is likely to push prices higher again.

The market’s job is to test our discipline. Our job is to follow a process that does not waver with emotion. That process is what gives us confidence, even when headlines are chaotic.

In the coming weeks, I will highlight several new trades generated by this system and show how changes in market emotion translate into measurable opportunities.

In the meantime, be sure to check out my newly released presentation on trading the coming after of an upcoming U.S. Supreme Court ruling on President Trump’s tariffs. Most investors haven’t heard about what’s going on and by the time they do it will be too late.

Next week they’re hearing arguments on whether the President has the constitutional authority to levy the tariffs the way he did. It’s been estimated that upwards of $1 Trillion is at stake. Whether they rule in his favor or not the markets will over react. A ruling against him could mean having to refund all of that money while a ruling for him could open up even more aggressive tariffs. Either will affect the market.

I’m positioning my portfolio now for the inevitable aftershock of the Court’s decision and you should too. Check out my presentation on how you can get started repositioning your portfolio today, click here.

Trump's Tariffs Judgment Day

Nine U.S. Supreme Court justices could decide the fate of $1 trillion in tariffs and trigger a market shock unlike anything we've seen in years. An award-winning trader reveals how to prepare before the verdict hits. Watch the urgent briefing before it all starts.