ZNGA posted a first quarter loss of $103.9 million, or 11 cents a share, as compared with a year-earlier loss of $128.8 million, or 14 cents. Revenue rocketed 52% higher to $403.8 million from $265.4 million year over year. Analysts were only looking for a loss of a penny a share on sales of $389 million.

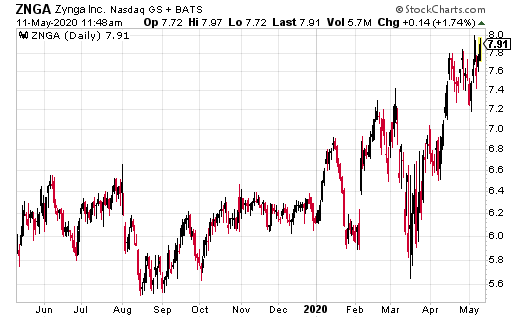

The ZNGA stock price today is up 33% since the mid-March market collapse and year to date up 27%.

ZNGA CEO Frank Gibeau estimates second quarter sales of $400 million, up 31% year-over-year, with bookings of $460 million, up $84 million year-over-year. “In Q2, we expect revenue of $400 million, up $94 million or 31% year-over-year, with bookings of $460 million, up $84 million or 22% year-over-year. Live services will drive our topline performance, led by our forever franchises, as well as the year-over-year additions of Merge Magic! and Game of Thrones Slots Casino,” he says.

“This overall momentum will be partially offset by year-over-year declines in older mobile and web titles. We also expect user pay to be the driver of our growth with advertising down year-over-year as we continue to lap prior advertising network optimizations and due to the recent pressure on advertising yields. Our topline guidance does not assume the launch of new titles in Q2,” added Gideau.

Related: ZNGA Signs First Deal With Amazon (AMZN) On Words With Friends 2

Zynga Higher on Video Game Boost in Pandemic

Video games are still thriving in the spotlight, as we have noted.

One of the top ones has been Zynga, which ran from a low of $5.80 to $7.50. All on the heels of the coronavirus and a World Health Organization note to play more video games.

“We’re at a crucial moment in defining outcomes of this pandemic. Games industry companies have a global audience – we encourage all to #PlayApartTogether. More physical distancing + other measures will help to flatten the curve + save lives,” tweeted Ray Chambers, U.S. ambassador to WHO. In fact, with millions of us staying at home, it could translate into higher sales for the company.

SunTrust Robinson Humphrey analyst Matthew Thornton is bullish on the stock as well with a price target of $7.50. “The maker of mobile and social games is likely to hold up or perhaps benefit from the coronavirus outbreak,” as quoted by Investor’s Business Daily.

As of this writing, Ian Cooper does not have a position in shares of ZNGA.