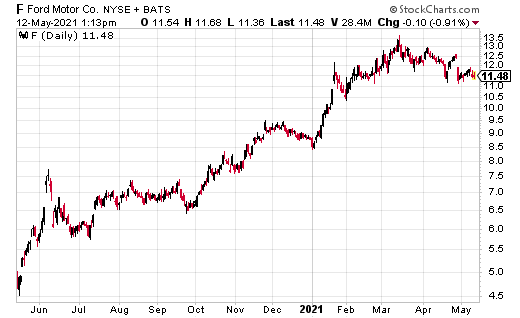

The global coronavirus pandemic disrupted the global “just in time” manufacturing strategy at a level that is just now starting to become clear. Manufacturers now have to live with unforeseen parts shortages, such as the computer chip shortage that have caused companies like Ford Motor Company (F) to cut back severely on its production plans.

Computer chips are just the chip of the iceberg when it comes to the problems companies will soon face in producing or acquiring goods to sell. Do not be surprised later in the year if you see prices skyrocketing or you even find that what you want to buy simply is not available.

I received a fascinating email last week from one of my subscribers, John, a very successful importer of retail goods. As background, understand that the U.S. imports approximately $200 billion worth of goods from China every month. On an annual basis, that comes to $2.4 trillion of imports, just from China. Assuming those represent wholesale values, sales of goods from China likely top $5 trillion per year in the U.S. That number, $5 trillion, equals about 20% of the entire U.S. GDP.

John operates as the middleman between Chinese manufacturing companies and U.S. retailers. I greatly appreciate it when he sends me updates on what’s going on in his world. Here is the email text I received last week:

“Subject: ocean freight

a year ago paid $2800-3300 for a 40′ box from Asia -USA

it’s now $15,500

contracts are worthless

it’s going to impact every aspect of retail & component supply chain

especially big ticket

I feel like I’m an Economic Paul Revere: ‘The Price Hikes are Coming’

couple that with shortages

my new slogan :

‘in 6 months ..those with the most inventory win’”

From the “where to invest” perspective, this outlook raises many questions without a lot of answers. Remember that both manufacturers and retailers are locked into the same just-in-time supply system, which, if what John says is accurate, may have run out of time.

While the Federal Reserve and financial news “experts” seem optimistic about inflation, I believe we could experience much higher prices for things we buy every day. The best cure to offset higher costs is more income. If your investment portfolio isn’t throwing off an 8% average yield, look at my Dividend Hunter service. Year in and year out, the Dividend Hunter recommendations have paid on average an 8% yield.