Dear Reader,

Corporations’ renewed focus on “returning cash to shareholders” is laudable, but misleading. As with all things investment-related, you can only determine whether something is a good deal for investors by understanding the nuances of how companies implement these policies.

When business results are good, corporate boards of directors often choose (as they should) to share the business’ profits with investors by “returning cash to shareholders.” These initiatives take on one or both of the following forms:

One type of cash return is to increase the regular dividend rate or pay a special, added dividend. Owners of the company’s stock receive cash into their brokerage accounts.

The other way to return cash comes in the form of share buybacks. In this scenario, a board of directors declares that a certain amount of money will be spent to buy shares in the open market, and then the shares are retired.

A share buyback reduces the number of shares outstanding, which results in an increase in the net earnings per share. Theoretically, growing the EPS should drive the share price higher.

The thing is, I have some issues with calling share buybacks “returning cash to shareholders.”

First, as a shareholder, I get nothing from the money spent on a share buyback plan. Describing buybacks as returning cash to shareholders is misleading. The institutions that sold those shares and so profited from the buyback are no longer shareholders of the repurchased shares.

Also, companies tend to enact share buybacks when business is good, and share prices are high. If a company buys shares near a share price peak and then the share value falls, all the cash spent on shares just disappears, wasted on a bad investment.

While there may be good reasons to reduce the number of shares a company has in the market, calling a buyback returning cash to shareholders is misleading. From my observation, companies announce buybacks because the Wall Street analysts like this type of corporate action.

This brings up the main point of my discussion today: A lot of companies are more focused on making analysts happy instead of trying to make shareholders wealthy. Corporate management teams spend a lot of time in contact with the analysts assigned to follow their businesses. It’s not surprising when companies lose sight of the investors who actually own shares of stock.

Cash dividends are truly returning cash to shareholders. I think investor-friendly companies focus on paying out a significant portion of profits as dividends. I don’t give a flying dropkick about what the Wall Street analysts think about the companies in which I invest. I do all I can to determine whether the management teams and boards of directors are focused on rewarding shareholders.

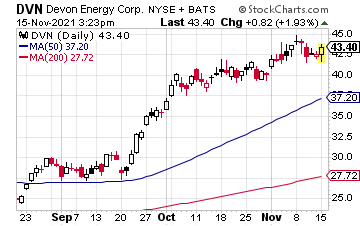

I want to invest in companies that think like Devon Energy (DVN), whose CEO Rick Muncrief stated, during the third-quarter earnings call, “…the top priority of our free cash flow is the funding of our fixed plus variable dividend. This unique dividend policy is specifically designed for our commodity-driven business and provides us the flexibility to return more cash to shareholders than virtually any other opportunity in the markets today.”That’s exactly what I do in my premium Dividend Hunter service. There, I show my subscribers a full portfolio of over 30 high dividend, low risk stocks. Together with my 36-month plan, those stocks can easily set you on the path to a retirement account that gets you enough income to pay your bills. Click here to learn how you can join and get access today.