There’s Such Much Oil, They’re Giving It Away

The big financial news lately hasn’t been coming from the stock market, but from the oil pits. With most people staying close to home, the global demand for oil has plunged, and its price has dropped through the floor.

Actually, not just through the floor, but several inches into the ground. Allow me to explain.

Supply and demand are out of whack, and there’s a large supply of oil that needs to be stored…but no place to put it. No one wants to own it—and I mean no one! On Monday, the price for the May futures contract for West Texas Intermediate actually went negative.

That’s not a typo. They were paying people to take oil. The lowest price I saw was minus $37.63 per barrel.

The One Stock Beating NetFlix, Disney, and the Rest of the Streaming Stocks While America Stays Home [ad]

As the old joke goes: “that’s not a bad price for a barrel.”

What’s Happening?

The whole oil market has been wrecked. If the Beverly Hillbillies were remade today, Jed Clampett and his kin might not have much reason to leave home.

I have to point out that we’re talking about the May futures contract. Later months don’t look so dire, when the over-supply shouldn’t be as much of problem. But right now, it’s a big honking deal.

How did we get here? Well, obviously the novel coronavirus was the main mover. Reuters notes: “The Russian energy ministry has told domestic oil producers to reduce oil output by around 20% from their average February levels.”

My response: HAHAHAHAHAHAHA

**wiping tear**

First of all, these countries rarely keep to their production targets. And while Russia isn’t a member of OPEC, it’s worth noting that members of that cartel almost always cheat.

The problem isn’t supply; it’s all about demand. No one is driving and most everything is shut down. Even the highways of Southern California are fairly clear; that hasn’t been seen in decades.

To Understand Oil, Let’s Look at Toilet Paper

What’s happening to oil is actually similar to what’s happening to toilet paper. Say what?

Give me a moment to explain. Once the coronavirus began to spread, we quickly saw a shortage of toilet paper. The question was: why? While there certainly was some hoarding, that wasn’t the cause of the shortage.

To put it in economic terms: the demand for toilet paper didn’t change. The difference is that folks weren’t using it at the office or at restaurants. The market for “residential” toilet paper and “commercial” toilet paper are completely different. They’re not even made at the same mills.

The supply chains for the American economy are managed at a hyper-efficient level. If the local Walmart says to be at its loading zone at 6:17 a.m., well, you’d better not be there a minute late. In the toilet paper market, once the demand for the commercial version of the product dropped off, the surge in residential use overran the system. The shelves quickly emptied.

That’s what happened with oil. The supply and demand variables are constantly worked to be in careful balance. The coronavirus made the whole darn equation go kablooey.

What to Do Now?

We’ve been handed a rare gift. Oil is a good short-term investment right now. But let me be clear that I’m talking about a very short-term move.

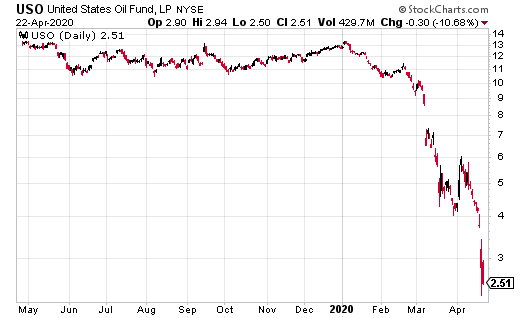

The main Oil ETF (USO) invests in oil via futures contracts. Their contracts have already been rolled over, so USO wasn’t crushed like the rest of the oil market. Interestingly, we didn’t see major energy stocks get smacked around, either…but to be fair, those stocks had already taken it on the chin.

Contracts for the future months for oil will see much more conventional prices. We’re seeing some political grumblings to reopen the economy, not just in the U.S. but in other countries, which may help spark further demand for oil. Or at least, it could ease some of the burden of the plunge.

Shares of USO look good here, but I would be quick to exit the position after a 20% gain from your entry point. Get in, get out, and move on.