Shares of Tesla Inc. (TSLA) are moving higher, as the company nears Battery Day on Sept. 22.

Anticipation is high the company will unveil a new battery that could last for up to a million miles before it gives out on that day.

“The million-mile battery could profoundly change the business model of electric vehicle manufacturing, analysts say. It also offers Tesla the means to significantly reduce the cost of making electric vehicles. Plus, the cost of owning its cars also could come down, providing Tesla with a huge competitive advantage,” reports Investor’s Business Daily.

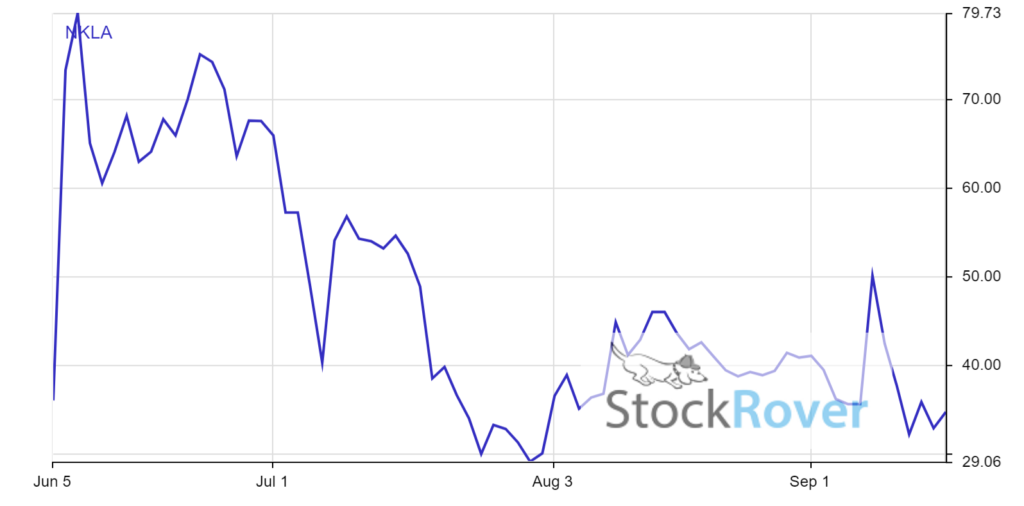

Shares of Nikola Corp. (NKLA) are still under pressure after two short seller attacks, and news the U.S. Justice Department is probing the company over claims it misled investors. “Specifically, federal prosecutors are probing allegations that Nikola, a maker of electric and hydrogen-powered semi-trucks that listed publicly in June, misrepresented progress it made in developing key technology core to releasing new models,” as reported by The Wall Street Journal. This follows a short seller attack from Hindenburg Research, which referred to NKLA as an “intricate fraud.”

Your 3-Step Retirement Plan

I strongly advise that you reconsider your retirement strategy after seeing THIS.

It’s a brand new three-step retirement plan designed to:

- Eliminate guesswork…

- Cut risk to the bone…

- Deliver more than enough income to retire safely

It’s working for absolute beginners right now…

And I have no doubts it will work for you. In fact — It wouldn’t surprise me if you NEVER run out of money in retirement following this unconventional, yet dead-simple approach.

If you want to see how that’s possible… following just three simple steps…

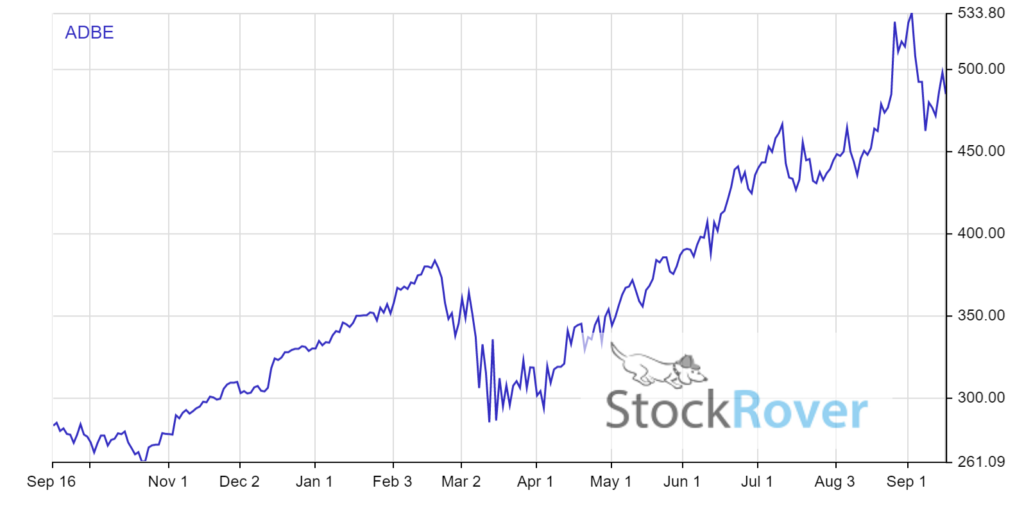

Shares of Adobe Inc. (ADBE) rocketed higher after beating Street estimates. The company expects for the momentum to continue for the rest of the year and beyond. Net income came in at $955 million, or $2.57 adjusted EPS, compared to net income of $7.93, or $1.63 year over year. Revenue was up 14% to $3.23 billion from $2.8 billion year over year. Guidance was above expectations, as well.

“Adobe delivered the best [third quarter] in our history in a challenging macroeconomic environment, demonstrating the global demand for our innovative solutions,” CEO Shantanu Narayen said, as quoted by Barron’s. “We are confident that our leadership in the creative, document and customer experience management categories will drive continued momentum in 2020 and beyond.”

Shares of Eastman Kodak Co. (KODK) raced higher after a special committee found that even though it did a poor job of corporate governance, it did not violate any laws.

“The manner in which the options grants were awarded was sub-optimal in a number of respects,” the lawyers at Akin Gump Strauss Hauer & Feld LLP said, as quoted by Bloomberg. “The lawyers determined that Kodak’s conduct didn’t violate the law, although the situation remains under investigation by U.S. securities regulators and Congress.”

Shares of Eli Lilly (LLY) ran higher on news it’s COVID-19 treatment reduced the hospitalization rate. “The U.S. drug maker said it tested three different doses of LY-CoV555 against a placebo in a trial enrolling roughly 450 patients. The middle dose of 2,800 mg met the trial’s target of significantly reducing the presence of SARS-CoV-2 after 11 days,” said CNBC.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.