The pandemic-triggered shutdown of a large portion of the global economy forced many companies to cut dividend payments, or at least stop growing their dividend rates, for most of the last year and a half. Although we now seem to be in a reopening phase, I sense a reluctance from Boards of Directors to bring dividend policies back to pre-coronavirus levels. However, a new type of dividend policy gives me hope for us investors who like to get cash returns from our portfolios.

Throughout 2021, instead of increased dividend rates, many companies have decided to use excess cash flow to either pay down debt (not a bad thing) or buy back shares.

I find it misleading when corporate management teams refer to share buybacks as “returning cash to shareholders.” When a corporation uses cash to buy back shares, the investor who owns the shares is no longer a holder of those shares and does not benefit from a positives the share buyback produces.

A buyback reduces the number of shares outstanding, so the net benefit is a growth in earnings per share. If dividend increases accompany the higher earnings, I am all for that; however, buybacks without dividend growth are not much of a benefit to investors.

Over the last few quarters, I have heard of many share buyback announcementsand very, very few meaningful dividend increases—especially in the areas I primarialy follow, commodities and energy-producing companies. I am disappointed in this lack of sharing the wealth with us regular investors.

However, there has appeared a light in the dividend-growth darkness. A small number of companies are now paying dividends based on measurable factors. These dividend policies mean that investors get paid more as the companies do better—what a concept!

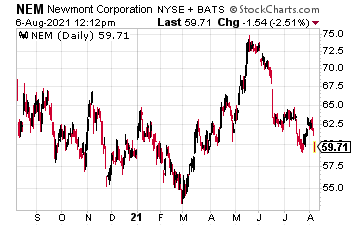

The trend started with Newmont Corporation (NEM). In October 2020, Newmont increased its dividend by 60% and instituted a new dividend policy:

This dividend increase is supported by a framework to return 40 to 60 percent of incremental attributable free cash flow to shareholders that is generated above a $1,200 per ounce gold price. Newmont’s dividend framework shares incremental free cash flow with shareholders at higher gold prices.

In this instance, the dividend increase was based on a $1,500 per ounce gold price assumption and a 40 percent payout rate applied to our previously articulated $1.2 billion incremental free cash flow for every $300 per ounce change in the gold price. Newmont’s base annualized dividend remains at $1.00 per share and is sustainable at a $1,200 per ounce gold price.

In February 2021, based on an average of $1,800 per ounce for gold, Newmont increased its dividend to $0.55 per share. As a shareholder, I look forward to higher precious metals prices!

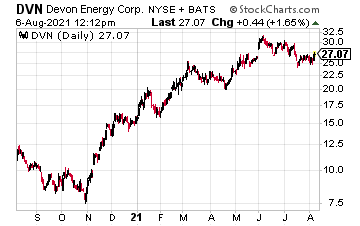

Also in February 2021, Devon Energy (DVN) announced an industry-first variable cash dividend. At that time, Devon added $0.19 to the regular fixed $0.11 quarterly dividend. Devon plans to pay approximately 50% of free cash flow each quarter as common stock dividends with the policy.

In May, Devon announced and paid a fixed plus variable dividend of $0.34 per share, a 13% increase over the previous payout. In July, the total dividend climbed to $0.49 per share. Devon knows how to return cash to shareholders.

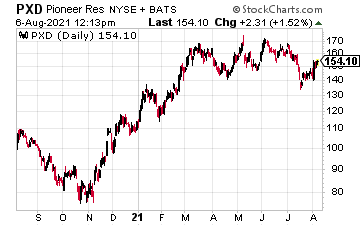

On August 2, Pioneer Natural Resource Company (PXD) announced the start of a variable common stock dividend policy. At that time, the company declared a $1.51 per share variable dividend added to the $0.56 base dividend. This new dividend policy is excellent news for PXD investors.

As for companies with results that vary with commodity prices: I hope more of them see what these three are doing to reward shareholders. When times are good, such as now with high crude oil prices, it is great to see investors share in the profits.