The pandemic-triggered stock market selloff has been incredibly tough on income investors, and the dividend-paying stocks they like to own. In the current market, investors have been drawn to big-name companies whose business was uninterrupted by the crisis. This group pays small or no dividends. Several factors have kept dividend-paying stocks down, but that means opportunity for patient investors.

For my Dividend Hunter subscribers, I discuss three factors that have hurt higher-yield stocks over the past three months.

- A large portion of the high-yield universe is energy sector companies. The crash in crude oil started even before the major stock market indexes. The dramatic drop in the price of oil helped pull energy stocks into an intense bear market.

- Before the crash, a strategy of leveraging portfolios of high-yield stocks was popular. The bear market forced many leveraged ETNs and CEFs to dump shares to stay afloat. A couple of dozen funds went entirely out of business.

- Hundreds of companies have reduced or suspended dividend payments. Investors are uncertain of which stocks will be the next to announce dividend reductions. This fear has held down share prices of higher yield stocks.

In recent weeks, Wall Street analysts have turned more positive on the stocks they believe will sustain their dividends. Stocks that pay attractive yields and are also highly rated by analysts are an excellent place to fortify the income-focused part of your investment portfolio.

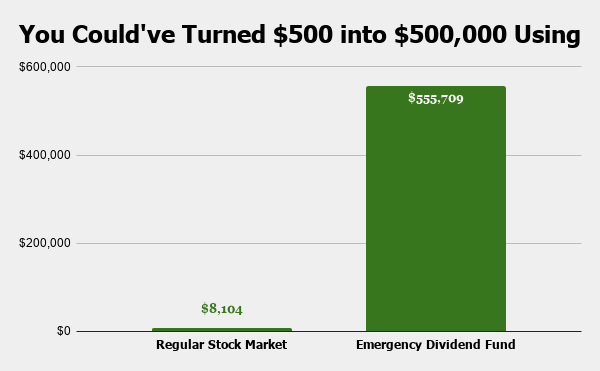

The Best Retirement Plan During Coronavirus

Thanks to one lucrative, government-restricted investing program…

Retirees are able to recover fast from this coronavirus market panic.

They’re enjoying bigger gains and income from the same investments and in the same amount of time… Without stressing about the recent market moves…

And for a limited time only, you can join them below…

Here are three high yield stocks getting bullish ratings.

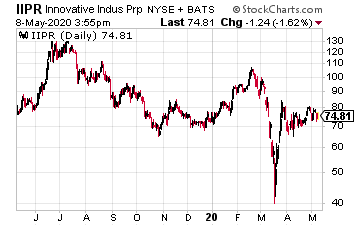

Innovative Industrial Properties, Inc. (IIPR) is rated bullish or very bullish by four of the five analysts that cover the company.

IIPR is a real estate investment trust (REIT) that provides real estate capital to the medical-use cannabis industry.

IIPR has paid a strongly growing dividend since its early 2017 IPO. In December 2019, the dividend increased by 28%, and the company declared another dividend at the same rate on March 13.

The shares yield 5.1%.

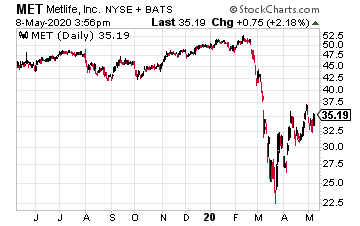

MetLife, Inc. (MET) has a bullish or very bullish rating from 11 out of 16 analysts that cover the stock.

MET has increased its dividend for eight straight years, growing the payout by an average of 8% per year.

At the end of April, MetLife increased the dividend by 4.5%. Based on the 2020 first-quarter net income, the payout ratio is less than 30%.

The shares currently yield 5.6%.

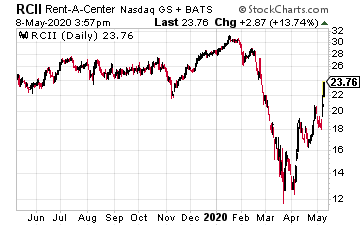

Rent-A-Center Inc. (RCII) has a very bullish rating from four Wall Street analysts and a neutral rating from the other five who cover the stock. Balancing out those two groups gives a moderately bullish overall rating.

RCII is a rent-to-own furniture and electronics retailer with more than 3,000 stores in the U.S.

The company reported robust first-quarter results and indicated that its business would perform better than traditional retail for the second quarter. The current dividend rate represents a 43% payout ratio based on the first-quarter net income per share.

RCII yields 6.4%.