The reopening of closed business in the U.S. has started in anticipation of today’s Memorial Day Holiday. The trend will accelerate as we move into the summer months. However, don’t expect every company to bounce back to what it was before the crisis. Many industries will suffer long-lasting effects from the shutdown. Others may benefit from an attitude change by consumers.

One new change that will stick is a focus on social distancing. People will no longer be told to stay home or shelter in place, but social distancing rules are expected to remain in effect at least until there is widespread vaccine availability.

Do NOT Collect Another Dividend Until You Read This

Please hold off on collecting your next dividend payment until you read THIS.

With one small change in your brokerage account you can set yourself up to collect 5x… 10x… even 25x more dividend income down the line…

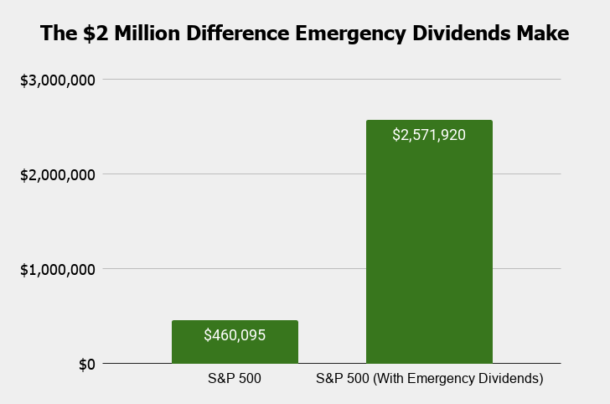

Take a look at the difference this makes in your potential income:

And all it takes is one change in your brokerage account…

But you have to hurry – Big Government recently put tight restrictions on advertising this secret…

And with coronavirus ravaging the market this could be your last chance…

That’s why I’m issuing this urgent alert.

Click here now to read all the urgent details.

If you’re at or near retirement age, you can’t afford to wait.

The next step will be social distancing for fun and adventure. By this, I mean, why stay home and watch Netflix again? Instead, get away from people by taking your boat into the middle of the lake to water ski or fish. Or load the family into a four-seat off-road ATV and explore the desert or mountain jeep trails. Or take the motorhome or travel trailer and get away to a national park or state park campground.

The point is that outdoor recreation is poised to become even more popular. Studies show that time spent outdoors is safer when it comes to transmission of the coronavirus than staying indoors. Just don’t ask any strangers to join you on your boat!

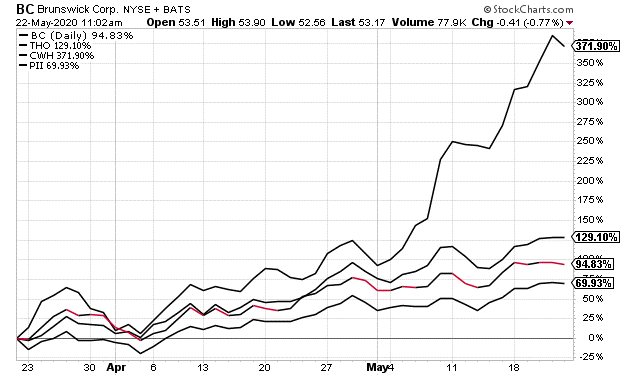

Here are four stocks to invest in and profit from following relaxed stay-at-home rules and warm weather this summer as a population that’s been cooped up for months gets out and about. The recovery for all four has outpaced the broader market since coming off the March lows.

Brunswick Corporation (BC) is a leading manufacturer in the marine recreational market.

BC produces 16 different brands of recreational boats, including SeaRay, Boston Whaler, and Crestliner.

The company also manufactures the Mercury and Mercury MerCruiser brands of boat engines.

BC shares have traded on the NYSE for 95 years. Brunswick is targeting over 6% annual revenue growth through 2022. The summer of 2020 will be a great start towards that growth target.

The BC dividend has increased for seven straight years at a double-digit annual growth rate.

The current yield is 1.8%.

Camping World Holdings (CWH) is an outdoor and camping retailer. Business TV personality Marcus Lemonis is the Chairman and CEO.

CWH’s 200 locations in 36 states offer RVs, camping gear, and RV maintenance and repair.

While it was founded in 1966, Camping World it wasn’t until an October 2016 IPO that CWH became a publicly-traded company.

The stock pays a regular $0.08 quarterly dividend and has paid a $0.0732 special dividend for each of the last two quarters.

The current yield based on the regular dividend is 1.6%.

Thor Industries (THO) is a leading RV manufacturer, producing class A, B, and C motorhomes, as well as travel trailers, fifth-wheel trailers, and toy haulers.

THO stable of brands includes Airstream, Entegra Coach, Jayco, and Keystone RV Company. The company also has a substantial presence in the European RV market.

In mid-May, THO released survey results that show 50% of consumers with intent to buy an RV in 2020 plan to purchase in May to August and that 58% of those with purchase intent are open to purchasing virtually, which offers additional opportunities for dealers to welcome consumers into the RV lifestyle.

Thor has grown its dividend for nine years with a high single-digit annual growth rate.

The current yield is 2.0%.

Polaris Inc. (PII) manufactures a range of power sports recreational vehicles, including snowmobiles, motorcycles, and off-road vehicles.

This last category is a very hot market sector, and PII is a leader in these vehicles with its RZR and Ranger brands.

As of the end of April, 85% of the Polaris dealer network remained open.

PII has grown its dividend for 23 straight years, averaging 5% annual growth for the last five years.

The current yield is 3.0%.