The Russian invasion of Ukraine has awakened other countries in Europe, which now realize they must recalibrate their security strategies and increase defense spending.

Even Germany, despite the pacifist strategy it has followed since the end of World War II, said it would sharply increase its spending on defense to more than 2% of its GDP. As German Chancellor Olaf Scholz told the German Parliament: “We will have to invest more in the security of our country to protect out freedom and democracy.”

That should translate to a windfall for the largest U.S. aerospace and defense companies.

The chief executives of Lockheed Martin (LMT), Raytheon Technologies (RTX), Boeing (BA), Northrop Grumman (NOC) and General Dynamics (GD)—all prime contractors for the U.S. Department of Defense—acknowledged in April earnings calls that they will profit from increased defense spending.

Northrup Grumman CEO Kathy Warden put it this way during the company’s earnings conference call: “Globally, there’s an ongoing paradigm shift regarding national security, and several allies have pledged to increase defense spending as a result.”

And of course, there is the U.S. defense spending, too. As the largest global spender on military equipment, the U.S. made up 38% of global defense spending in 2021. Overall spending on the military worldwide topped $2 trillion for the first time ever in 2021, according to the Stockholm International Peace Research Institute.

According to think-tank the Center for Strategic and International Studies (CSIS), here in the U.S., defense contracts accounted for 58% of the Department of Defense’s spending in 2020, the highest proportion in 20 years. Of the $421 billion doled out that year, 36% went to the “big five” contractors listed above, up from just 19% in 1990.

Stock prices for Lockheed, Northrop Grumman and General Dynamics are up 10% to 15% since the start of the war in Ukraine, far outperforming the overall market; however, it will not be all smooth sailing for these firms as they ramp up to meet the increased demand from Europe.

Supply Chain Problems

The defense industry has the same problem as many other industries at the moment: snarled supply chains.

These supply chain issues (including labor constraints), as well as inflationary pressures, could hold back efforts to scale up production.

For example, consider the weapons that have become so important to Ukraine’s efforts to defend its country: the shoulder-fired Stinger and Javelin missiles.

Raytheon’s CEO Greg Hayes spoke about them on its recent earnings call with analysts explaining that the company’s Stinger missiles need an electronic redesign and new materials sourcing, so orders for replacements will not be fulfilled until 2023 or 2024. “We have a very limited stock of material for Stinger production,” he explained.

Russia had been a major source of titanium for Raytheon. As a result, Hayes said, “Trying to find titanium sourcing today is very difficult.” The company is working with the Department of Defense, which has not purchased a Stinger for 18 years, on resourcing materials.

Unfortunately, there is a similar timeline for Javelin missiles, which Raytheon co-produces with Lockheed Martin.

Javelin production capacity stands at 2,100 missiles per year, but the two companies aim to raise that annual number to 4,000. The ramp-up could take “a couple of years,” Lockheed CEO Jim Taiclet explained, “because we have to get our supply chain to also crank up.”

Despite the supply chain woes, the big U.S. defense companies will still prosper and make shareholders a lot of money in the years ahead.

Defensive Dividends

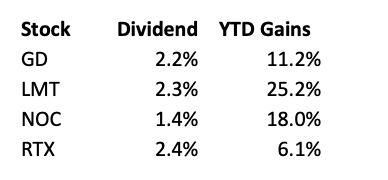

As for which of these companies will be the most profitable investments, I would avoid Boeing because of the well-known problems with its commercial airplanes. But the other four companies are investable… and for income-seeking investors, the added good news is that the remaining companies pay decent dividends. See the table below.

If I had to choose only one of these companies in which to invest, I would go with the largest defense contractor, Lockheed Martin, which also happens to have the highest yield.

I like the company’s focus on international revenue diversification, which now accounts for more than 25% of its sales. Ongoing geopolitical tension will benefit sales and earnings going forward.

The new management team signaled to Wall Street that near-term earnings growth will slow because of those supply chain issues, although the longer-term outlook remains upbeat.

However, in typical Wall Street fashion, Lockheed has focused only on the short term. Many traders have exited the stock, creating an opportunity for value investors. The P/E of 16-times is at the low end of the historical range.

In September 2021, Lockheed Martin raised its quarterly payout by 8%, to $2.80 per share—or $11.20 annually—for that above-industry-average yield of about 2.4%. I believe the payout is secure and, based on history, expect it to grow each year for the foreseeable future. Here are LMT’s annual payouts since 2015: $6.15, $6.77, $7.46, $8.20, $9.00, $9.80 and $10.60.

The dividend forecast, from Argus Research, is for an $11.80 payout for 2022 and $12.80 for 2023.

Lockheed Martin is a buy in the mid-$400s price range.