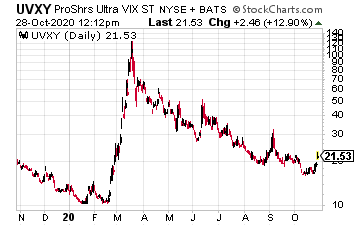

Volatility ETFs, such as the ProShares Ultra VIX Short-Term Futures ETF (UVXY) saw further upside as the markets melt down ahead of the U.S. elections, and on rising coronavirus case numbers. Over the weekend, the U.S. saw another 83,000 cases, overwhelming and exhausting hospitals. There’s even the fear of a return to lockdowns to stop the spread.

What could make the situation far worse is winter. “The coronavirus crisis may be entering a more dangerous period in the U.S. as the country heads toward winter season and temperatures fall,” says Andy Slavitt, former acting administrator at the Centers for Medicare and Medicaid Services, as noted by CNBC.

Buy and Hold This Dividend Stock Forever. It Pays 8.4% and Has Raised Dividends Every Year For a Decade [ad]

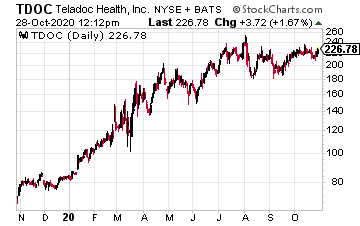

Shares of Teladoc Health (TDOC) ran to $223 a share on the pandemic scare, too. After all, “The critical need for social distancing among physicians and patients will drive unprecedented demand for telehealth, which involves the use of communication systems and networks to enable either a synchronous or asynchronous session between the patient and provider,” said Victor Camlek, healthcare principal analyst at Frost & Sullivan.

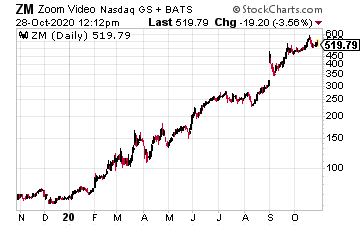

Zoom Video Communications (ZM) exploded to $544.50 on the pandemic, as well. Al as teleconferencing becomes a big part of the “new norm.” According to Reuters, “Video-conferencing platforms, once used mostly as a technological substitute for in-person meetings, became a vital part of day-to-day life this year for people stuck at home under coronavirus restrictions, be it for work, school or socializing.”

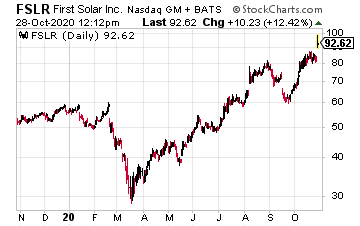

Shares of First Solar (FSLR) exploded more than $8 a share earlier this week on news of a massive jump in third quarter sales, which were up 70% year over year. FSLR earned $928 million, or $1.45 a share up from $546.8 million, or 29 cent a year earlier. For the full-year, the company expects to deliver net sales in a range of $2.6 billion and $2.9 billion thanks to “strong fleet-wide production.”

“The dedication we continue to witness from our associates enabled us to expand module segment gross margin, close the sales of our Ishikawa, Miyagi, and Anamizu projects in Japan, and increase earnings per share quarter-over-quarter,” Mark Widmar, First Solar’s CEO said, as quoted by Business Insider.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.