The 3D printing industry is a fascinating look at how technology has accelerated since the adoption of the space from just five or six years ago. New applications like polymer printing and other innovations that include aerospace, medical and construction have created a wider range of potential items that can now be produced.

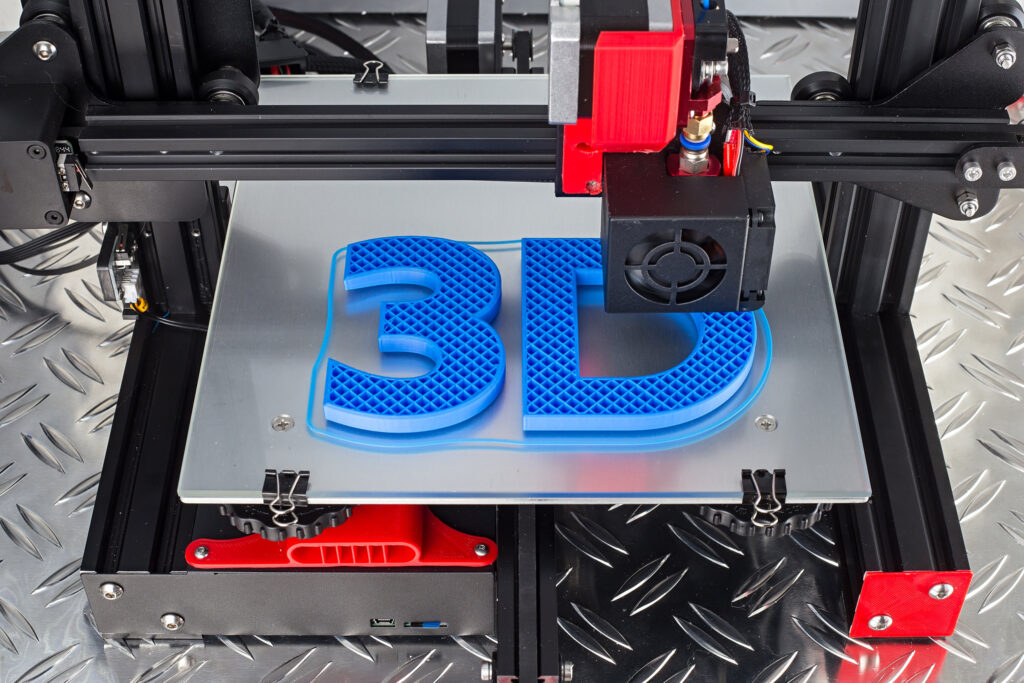

Simply put, 3D printing is an additive manufacturing process that is used to create three dimensional objects, layer-by-layer, by using a computer created design. There are a number of software applications that can be used to create a 3D item with less material wastage and cost savings.

One of the leading manufacturers in this space is Stratasys (SSYS) with the industry starting to reach an inflection point for additive manufacturing. There are a wave of new companies that are increasingly adding 3D printing to their production plans that is driving the shift from prototyping to mass production.

Following years of disappointing results, the company is finally starting to live up to Wall Street’s expectations. In its most recent quarter, Stratasys reported third-quarter earnings of one-cent a share versus expectations for a loss of six cents. Revenue of $159 million also topped forecasts of $150 million.

This represented revenue growth of 24% and systems sales growth of nearly 35% year-over-year, with contributions across all regions and business lines. The company said it also achieved a number of important manufacturing-focused milestones, including the securing of contracts with the U.S. Navy and a major international original equipment manufacturer (OEM), specifically for end-use part production.

For the current quarter, Stratasys expects a 16% increase in revenue, with forecasts at $158 million with fiscal year capital expenditures of $24-$30 million. The company also said it continues to expect significant leverage benefit from its investments as revenue growth should start to accelerate in 2022 and beyond.

Wall Street, on average, have pegged 2022 earnings at 12 cents a share on revenue of $669 million. However, the high estimate has Stratasys earning up to 31 cents a share on revenue of north of $700 million.

Currently, there are 18 analysts that cover the stock with one strong buy and three buy recommendations. Ten analysts rate the stock a hold while three have underperform along with one sell recommendation.

Despite the earnings beat and raised outlook, the chart shows shares have been in a nasty downtrend since peaking at $42.83 earlier this month. The recent close below the 50-day moving average is somewhat of a concern as there is risk towards $26-$24 and the 200-day moving average on renewed weakness.

The $24 area represents prior resistance from August and September before the early October breakout above this level. A move above $30 would likely indicate the recent selling pressure has abated.

On a fundamental basis, it may be prudent to wait another quarter, or two, to see if the turnaround story for Stratasys is for real as there remains heavy competition in the 3D printing industry. Autodesk (ADSK), HP (HPQ), 3D Printing (DDD) and Desktop Metal (DM) are some of the other stocks also making headway in the sector.