Sonic Automotive’s (SAH) latest earnings release revealed a major hit from COVID-19 in the form of a goodwill writedown. While earnings actually increased in the quarter, the charge had a negative impact on the company’s balance sheet.

Under GAAP, the company had to record “a non-cash goodwill impairment charge of $268 million related to its franchised dealerships reporting unit as a result of a decrease in SAH’s market value due to the COVID-19 pandemic’s effect on the stock market and expected reduction in economic activity in the near term.”

Including the charge, SAH reported GAAP earnings per share of negative $4.67. But, excluding the charge, the company reported earnings of $0.40 per share, a penny higher than the year-over-year first quarter of 2019.

Revenue for the quarter was $2.3 billion, and produced gross profit of $350.6 million. Importantly, the company’s major growth focus for the past few years, the EchoPark concept, reported revenue of $331.7 million, a 33% increase year-over-year.

EchoPark opened its ninth location in Long Beach, California late last year, with a planned opening in Atlanta scheduled for this year.

David Smith, Sonic Automotive CEO, said the company was having a great start to 2020. “Through the first two months of 2020, same store total revenues increased 17% versus the comparable two-month period in 2019, driven by an 11% increase in new vehicle unit sales volume, a 27% increase in used vehicle unit sales volume and an 8% increase in Fixed Operations revenues.”

But as COVID-19 forced the closure of businesses in March, the company saw a drop in traffic. Sonic has been declared an essential business, but even though the company kept showrooms open, Smith said, “…we have experienced a significant reduction in customer foot traffic in both our service and sales businesses.”

Jeff Dyke, Sonic’s EchoPark President, said the unit is retrenching in the current environment, and tackling cost-cutting efforts. In an attempt to shore up the balance sheet, he said the company is “continuing to enhance our liquidity outlook by lowering operating costs, postponing certain capital expenditures and working with our manufacturer and lending partners to access additional sources of liquidity.”

Even with the impact of COVID-19, Sonic continues to have a strong balance sheet, and has drawn down a line of credit to ensure stability. At the end of April the company had total available liquidity of approximately $418 million.

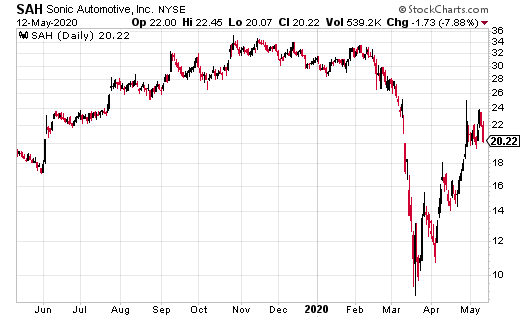

Sonic’s stock has moved from the mid-$30s to trade at just over $21 at current levels. The company has a PE of just below 9.

Steven Adams’s personal position in Sonic Automotive: none.