After several weeks of slow and steady climbing, stocks have finally shown vulnerability over the past week. Tech stocks in particular have taken a pretty sizeable beating; however, most of the big-name tech companies are still solidly in the black for the year.

Nevertheless, some of the best performers this year are seeing massive selling of their shares. For example, Tesla (TSLA) dropped 21% on Tuesday alone (its biggest one-day drop ever). The electric vehicle leader had been on fire since first announcing and then undergoing a stock split. Another recently split stock, Apple (AAPL), has also pulled back 20% from its all-time high (set about a week ago).

Is this simply a case of sector rotation? That is, are investors taking their tech profits off the table and moving into other sectors? That certainly seems to be part of it. However, the broad market has been declining as well, with bond prices moving higher. That’s generally a sign of investors taking risk off the table.

Perhaps macro-level concerns about the geopolitical and economic landscape are finally weighing on investors. After all, what is possibly the most important election in modern American history is coming up in November. The coronavirus pandemic is still raging across much of the country. And hostile rhetoric is starting up again between the U.S. and China.

“…by my calculations that is a whopping 1,542% profit!!!” [ad]

If investors feel like it’s time to take some money out of the stock market, who can blame them? In times like these, you expect to see investors move into defensive assets like bonds, utilities, and… precious metals.

Yes, precious metals have slowed their climb in recent weeks, but their day in the sun may not be over. Gold and silver could both see much higher prices before the end of 2020 if uncertainty continues to dominate the financial markets.

To focus on silver, the metal has flattened out in a range between roughly $26 and $29 per ounce since August began. That’s still significantly higher than the $18/ounce level it had been it for most of the year. But could it be ready to break out to even higher levels?

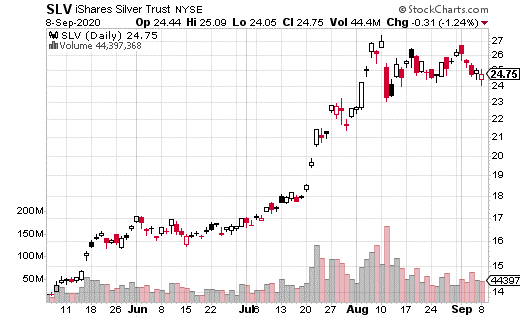

Let’s look at options on iShares Silver Trust (SLV), the most popular trading method for the metal. SLV is up 50% year-to-date, but the rally has stalled every time the ETF hit the $27 level. Still, at least one well-capitalized options trader thinks there could be substantially more upside by mid-January.

The trader bought 15,000 call spreads that expire on January 15. A call spread is when a lower strike call is purchased (for upside potential) with a higher strike call sold (to lower the cost of the trade). In this case, the 39 call was purchased while the 45 call was sold with the stock at $24.59.

The cost of the spread was 20 cents, which means the trader spent $300,000 in cash. That’s also the max loss if SLV doesn’t climb above $39 by expiration. Breakeven for the trade is $39.20, and max gain is at $45. At max gain the trader can make $5.80 or $8.7 million.

Clearly, SLV climbing that far from current levels is not a high-probability bet. However, this very large trade suggests there is at least the possibility of another leg higher in silver in the next four to five months. Maybe it’s a cheap way to protect against uncertainty. However, it seems more likely to be an inexpensive way to profit if silver does spike higher.